Will the market for retirement housing collapse when Baby Boomers go Bust?

A recent clickbait article online opines that a crises in retirement housing is upon us. Baby boomers will all die at once, and their houses will go on the market all at once. Since the "working" younger generation isn't interested in housing in The Villages, the housing market for retirement homes will collapse.

Is this true? Maybe a little bit. Maybe a little exaggerated to sell newspapers, or today, eyeballs. As the old adage in the news business goes, "Dog Bites Man" isn't a story, "Man Bites Dog" is.

This boner in the article really jumped out at me:

In the decade between 2007 and 2017, around 730,000 homes hit the market that were previously owned by seniors each year. But that number is expected to grow exponentially over the next couple decades. Between 2017 and 2027, 920,000 homes will be released into the market each year by people aged 60 or older, according to a new analysis from real-estate company Zillow. By the decade between 2027 and 2037, the figure is project to hit 1.17 million homes a year.

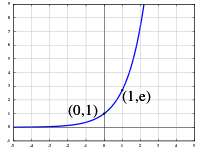

Sadly, math isn't taught to "Communications" majors, who throw around the term "exponential" without knowing what it really means. Mea culpa, I throw around the term as well, and I should know better. As illustrated above, an exponential function is one where and thus increases by power of x over time, often rising dramatically. The data they have provided, however, doesn't seem to fit this curve. I made a crude plot of the data they provided in a WORD document:

Of course, it is hard to tell whether the function is linear or exponential, given only three data points. But if you look at the data, the projected increase in sales is fairly linear over time - and the time period is thirty years from now. 1.17 million homes for sale might sound like a lot, but close to six million homes change hands every year as it is, and this number has increased steadily over time. In thirty years, it is likely that home sales will increase by over a million homes anyway. This 1.17 million number doesn't take into account the natural growth of the housing market. Moreover, it doesn't take into account that while a lot of Boomers are dying off, that doesn't mean nobody else is retiring after them.

Demographics are important, as I have noted before. The "age pyramid" looks more like a minaret today, with the widest point being folks like myself, born in 1960. But there were also people born in 1961, and 1962, and so on and so forth. Maybe not quite as many, but more than zero, by a long shot. Thus, it is not like 1.17 million surplus homes will hit the market every year and remain unsold. There will be people still retiring and looking to buy, perhaps not quite as many, though.

And, as I illustrated before, sometimes small shifts in the ratio of buyers to sellers can result in large swings in home prices (or prices of any commodity). If you have 99 homes for sale and 100 buyers, someone is not going to have a house to buy. And buyers will bid up the price of homes by 10% or more, in such a market, as the increase in monthly payment is not as dramatic. But for a 1% difference between supply and demand, a much greater difference in price can occur. And the same is true if there are 100 buyers and 101 homes for sale - someone's house isn't getting sold and prices may drop by 10% or more until either a new buyer is enticed into the market, or a seller steals a buyer from another seller.

But I don't think anything as dramatic as the real estate meltdown of 2008 will occur - or the bubble of 1989, either. First of all, the premise that all senior housing is unsalable to anyone other than a retiree is flawed. Sure, maybe places like The Villages are pretty impractical for folks who are not retired. Those houses are not near places of employment - today. Similarly, an ocean house on the Outer Banks might be a rough commute to Raleigh. But many Seniors are retiring in places where people do work. Many in fact, such as my former neighbors, retire in the same houses they lived in while working. Fairfax County has a number of retirees who are living in the same houses they bought when they worked at the Pentagon. Those houses won't remain unsold when their owners kick the bucket. Other locals will want to buy them.

Second, the idea that masses of retirees will go into assisted living and need to dump their homes may also be overstated. In yet another clickbait article, the Wall Street Journal argues that developers are losing their shirts with assisted living construction, as retirees are choosing to "age in place" rather than go to "the home". And maybe this is also partly true.

Another neighbor of mine decided to go live in "Waters Edge" elderly apartment community after her husband died. She thought the house was "too much to keep up" and decided to downsize. Two months later, she moved back home. "Nothing but a bunch of gossiping old biddies over there!" she said, "And they're all Republicans!" She stayed in her home for few more years, hiring a part-time aid as well as a maid and lawn care service to assist her. She could afford it.

She finally sold the house and built a new house to live in with her children, which also seems to be a trend among many oldsters. Why blow money on a senior living center, when you can help your kids pay off their mortgage, by staying with them in an "in-law" apartment?

So there is some truth in both articles. There will be a demographic shift in coming years, and yes, it is possible that demand for houses in strictly retirement communities will drop slightly over time. And yes, some seniors will "age in place" which will help attenuate this decline. But I think also, what this means is that there will be less construction of retirement housing, as time progresses.

Right now, in The Villages they are building like mad - expanding almost all the way to I-75. And the houses being built are rather lavish. While the majority of homes there range from under $100,000 for a trailer home to $500,000 to something more elaborate with a swimming pool, there are also houses costing millions of dollars. Who is buying these homes is beyond me, but apparently there are a lot of people with a lot of money in this country.

The folks who run places like The Villages aren't stupid - they are building because people are buying. But if sales start to slow down, you can bet that construction will, as well. They aren't going to build houses that don't sell. And I think that will be the real consequence of this demographic shift - not so much a decline in real estate values, but a shift in construction from elderly housing to younger demographics.

It also is possible that a lot of what is "retirement housing" can become housing for people in their working years. Our condos in Pompano beach were originally apartments rented out to retirees. The entire area, lined with canals, was a retirement paradise for retired auto workers and mafiosos from "Up North". By the time we moved there, it had transitioned into housing for local Florida trash. The area had once been a set of small cities separated by miles of orange groves or swamp. But over time, it turned into single mega-city extending from Homestead in the South to Jupiter in the North.

As for me, I am not worried. While a lot of my friends in their 80's are leaving the island feet-first, or going into assisted living, or living with relatives, many more are moving in. A new generation of 50-somethings with an awful lot of money are moving here, often buying homes at asking price ($500,000) and then gutting them and putting another $200,000 to $500,000 into them. And for many of these folks, these are vacation homes! Certainly they have more money than I do, and when the time is right, I will gladly sell out to one of this new generation.

Perhaps this narrative that anyone who isn't a baby boomer is impoverished is a little overstated.

But then again, people love to click on "let's feel sorry for ourselves" headlines. Or better yet, "Baby Boomers Get Their Comeuppance!" headlines.

Whatever sells eyeballs!

This does not look like an exponential function, but more like a linear one.

Of course, it is hard to tell whether the function is linear or exponential, given only three data points. But if you look at the data, the projected increase in sales is fairly linear over time - and the time period is thirty years from now. 1.17 million homes for sale might sound like a lot, but close to six million homes change hands every year as it is, and this number has increased steadily over time. In thirty years, it is likely that home sales will increase by over a million homes anyway. This 1.17 million number doesn't take into account the natural growth of the housing market. Moreover, it doesn't take into account that while a lot of Boomers are dying off, that doesn't mean nobody else is retiring after them.

Demographics are important, as I have noted before. The "age pyramid" looks more like a minaret today, with the widest point being folks like myself, born in 1960. But there were also people born in 1961, and 1962, and so on and so forth. Maybe not quite as many, but more than zero, by a long shot. Thus, it is not like 1.17 million surplus homes will hit the market every year and remain unsold. There will be people still retiring and looking to buy, perhaps not quite as many, though.

And, as I illustrated before, sometimes small shifts in the ratio of buyers to sellers can result in large swings in home prices (or prices of any commodity). If you have 99 homes for sale and 100 buyers, someone is not going to have a house to buy. And buyers will bid up the price of homes by 10% or more, in such a market, as the increase in monthly payment is not as dramatic. But for a 1% difference between supply and demand, a much greater difference in price can occur. And the same is true if there are 100 buyers and 101 homes for sale - someone's house isn't getting sold and prices may drop by 10% or more until either a new buyer is enticed into the market, or a seller steals a buyer from another seller.

But I don't think anything as dramatic as the real estate meltdown of 2008 will occur - or the bubble of 1989, either. First of all, the premise that all senior housing is unsalable to anyone other than a retiree is flawed. Sure, maybe places like The Villages are pretty impractical for folks who are not retired. Those houses are not near places of employment - today. Similarly, an ocean house on the Outer Banks might be a rough commute to Raleigh. But many Seniors are retiring in places where people do work. Many in fact, such as my former neighbors, retire in the same houses they lived in while working. Fairfax County has a number of retirees who are living in the same houses they bought when they worked at the Pentagon. Those houses won't remain unsold when their owners kick the bucket. Other locals will want to buy them.

Second, the idea that masses of retirees will go into assisted living and need to dump their homes may also be overstated. In yet another clickbait article, the Wall Street Journal argues that developers are losing their shirts with assisted living construction, as retirees are choosing to "age in place" rather than go to "the home". And maybe this is also partly true.

Another neighbor of mine decided to go live in "Waters Edge" elderly apartment community after her husband died. She thought the house was "too much to keep up" and decided to downsize. Two months later, she moved back home. "Nothing but a bunch of gossiping old biddies over there!" she said, "And they're all Republicans!" She stayed in her home for few more years, hiring a part-time aid as well as a maid and lawn care service to assist her. She could afford it.

She finally sold the house and built a new house to live in with her children, which also seems to be a trend among many oldsters. Why blow money on a senior living center, when you can help your kids pay off their mortgage, by staying with them in an "in-law" apartment?

So there is some truth in both articles. There will be a demographic shift in coming years, and yes, it is possible that demand for houses in strictly retirement communities will drop slightly over time. And yes, some seniors will "age in place" which will help attenuate this decline. But I think also, what this means is that there will be less construction of retirement housing, as time progresses.

Right now, in The Villages they are building like mad - expanding almost all the way to I-75. And the houses being built are rather lavish. While the majority of homes there range from under $100,000 for a trailer home to $500,000 to something more elaborate with a swimming pool, there are also houses costing millions of dollars. Who is buying these homes is beyond me, but apparently there are a lot of people with a lot of money in this country.

The folks who run places like The Villages aren't stupid - they are building because people are buying. But if sales start to slow down, you can bet that construction will, as well. They aren't going to build houses that don't sell. And I think that will be the real consequence of this demographic shift - not so much a decline in real estate values, but a shift in construction from elderly housing to younger demographics.

It also is possible that a lot of what is "retirement housing" can become housing for people in their working years. Our condos in Pompano beach were originally apartments rented out to retirees. The entire area, lined with canals, was a retirement paradise for retired auto workers and mafiosos from "Up North". By the time we moved there, it had transitioned into housing for local Florida trash. The area had once been a set of small cities separated by miles of orange groves or swamp. But over time, it turned into single mega-city extending from Homestead in the South to Jupiter in the North.

As for me, I am not worried. While a lot of my friends in their 80's are leaving the island feet-first, or going into assisted living, or living with relatives, many more are moving in. A new generation of 50-somethings with an awful lot of money are moving here, often buying homes at asking price ($500,000) and then gutting them and putting another $200,000 to $500,000 into them. And for many of these folks, these are vacation homes! Certainly they have more money than I do, and when the time is right, I will gladly sell out to one of this new generation.

Perhaps this narrative that anyone who isn't a baby boomer is impoverished is a little overstated.

But then again, people love to click on "let's feel sorry for ourselves" headlines. Or better yet, "Baby Boomers Get Their Comeuppance!" headlines.

Whatever sells eyeballs!

and thus increases by power of x over time, often rising dramatically. The data they have provided, however, doesn't seem to fit this curve. I made a crude plot of the data they provided in a WORD document:

and thus increases by power of x over time, often rising dramatically. The data they have provided, however, doesn't seem to fit this curve. I made a crude plot of the data they provided in a WORD document: