People who are gullible enough to get ripped off a first time are prime bait for a second rip-off.

Welcome to the United States of Go Fuck Yourself. When I was a kid, there were laws against most of what people today call modern finances. Back in the 1960's, your local banker took deposits and paid "bank interest" of 3 percent or so, and then loaned out money at 6 percent with mortgages or car loans - and made a profit on the difference. The model of banking was helping your customers with their goals and dreams in life.

Today, banks and financial institutions have found it far more profitable to absolutely ruin people and make money by shattering people's dreams. Today, you can sign a piece of paper and literally sign your life away, often at an early age - as young as age 18. You sign $100,000 or more in student loans, and have a fun party for four years and then have to pay for it the rest of your life. If you can't find a job - because you majored in party studies - your debt may balloon to two or three times the original amount, if you signed odious private loans.

But the list goes on and on. Have a gambling habit? The government will sell you lottery tickets, and an "Indian" casino isn't more than a half-hour away. Want to buy a house you really can't afford? A whole industry exists with one goal in mind - to destroy your credit rating. Buy a boat or a motorhome on a 20-year note - and you'll be upside-down for 15 years of that note, if not more.

The list goes on and on. Payday loans, title pawn loans, rent-to-own furniture, buy-here-pay-here used cars. You can get into these deals and can't get back out of them. And declaring bankruptcy isn't a way out anymore. For student loans, it is often a non-starter. For other debts, it merely forces you to "work out" the debt over a period of years.

None of this existed when I was a kid. Usury laws prevented people from loaning money at 10% interest rates and above. Bankruptcy wiped out debts, so banks didn't lend money to people who looked like bad credit risks. When someone went bankrupt, people didn't blame the borrower, but the lender for being foolish enough to lend to insolvent people. Gambling was illegal, as were lotteries. You needed a 20% down payment on a house. And no one wrote car loans for more than three years - and 20-year motorhome loans didn't exist, nor did half-million-dollar motorhomes.

Today, you have to be careful - one wrong move and you've screwed yourself for life, with no "do-over" allowed.

Oh, sure, you say, I know that. But those are ripoffs that target the poor and uninformed, right? Middle-class people don't fall for this nonsense, do they?

Oh, but they do. The motorhome and boat sales target the middle class. Student loans often entangle the middle class and their children (particularly when parents co-sign loans). Many middle-class people get 7-year loans or lease cars to "free up cash flow" and because of "opportunity cost" arguments. The middle class is disappearing in this country, because they are giving their money away - to unscrupulous operators who target this rich vein of gold. Why scam the poor? They have no money. Better to scam the middle class - they have money, and no idea of what it is worth.

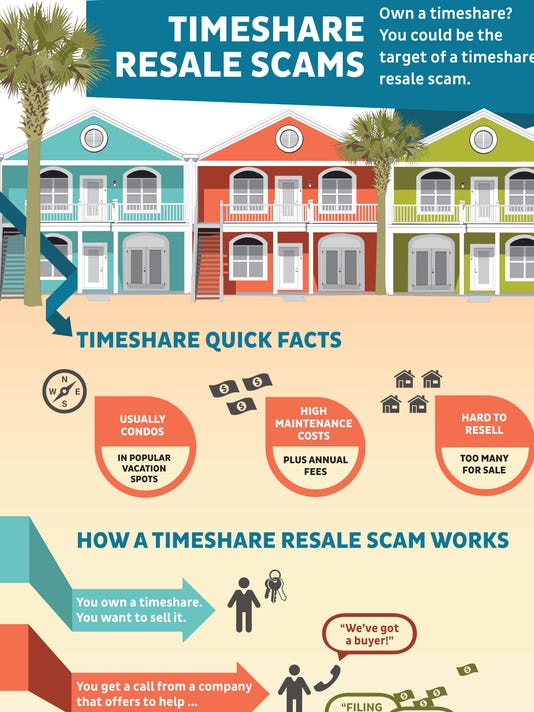

Timeshares have been a scam for decades now. Supposedly the idea started in the 1970's when a developer built a number of condos and couldn't sell them because the market collapsed. So they sold them on a weekly basis and the timeshare was born. It took off from there, with developments being put up explicitly to sell timeshares. Maybe it started out as a legit deal, but it quickly went downhill into scam territory.

I said before you can spot a rotten deal by how it is presented. Loud TV ads, deceptive mailed brochures, cold calls saying you "won" a contest you never entered - all warning signs you should stay away. But if you fall for one of these, and they get you to go to a "seminar" where you win a free barbecue grill or a cheap radio or something, you will be forced to sit through hours in an overheated conference room while salespeople tell you how you can "own your vacation" and how buying a timeshare is a "smart investment!"

And before long, the person sitting next to you will nudge you and say, "Say, this seems like a good deal! I'm going to sign up - for two weeks!" And after all, for less than the cost of a nicely optioned car, you can own a timeshare - right? By the way, the person sitting next to you who said he was going to buy, well, he works for the timeshare company. Yes, they use shills in the audience!

What's not to like? And if you don't like it, you can sell it to someone else - for a profit! Right?

Wrong. We actually looked into a timeshare in Key West, owned (or branded by) a major hotel chain. Key West - how could you go wrong, right? Well, you had to pay tens of thousands of dollars for each "week" you bought, with the most desirable weeks costing even more. The kicker was, there was an annual fee you had to pay on top of this - starting at $800 for this resort (and this was more than a decade ago, so I am sure it is double that, now). Back then, you could almost rent a hotel room for $800 a week, without having to borrow money to "buy" a week of it as well.

The timeshare resort sets the annual fee - which covers maintenance, utilities, and so forth. Sometimes there is also a "cleaning fee" to pay for the maids to clean your unit. And you may have to pay taxes and insurance on top of this - it depends on the resort. The annual fee will likely go up over time. And once the resort is a few years old, it may go up considerably as all the units are sold and they can raise the rates without having to worry about scaring off new sales.

So you are signing a blank check here, in terms of this fee. And unlike a condo, you really don't have a "voice" in how the place is run, so you can't vote out the board of directors if the fees get to be too high.

So years go by and you visit the resort less and less - but still have to pay the fee. Or your life circumstances change - and they will, eventually. You get older and can't travel and going to the timeshare isn't in the cards. Or you move away and it isn't convenient to go to the timeshare anymore.

So, OK, you sell it, right? Well, that's the joke - there is usually no resale market for these timeshares. The fees are so high that most people shy away from them. And since you can't sell them, you are stuck with the timeshare and can't get rid of it and cannot stop paying the fees.

So, I'll just stop paying the fees, right? Well, you can, but then they sue you for the fees due, which results in a judgement against you which destroys your credit rating. They put a lien on the unit, which means it cannot be sold until the back fees are paid (which doesn't matter, as no one wants to buy these anyway). Bankruptcy is the only way out of the deal, and chances are, you aren't in a position to declare bankruptcy over this - not without losing a lot of other assets in the process.

So you pay and pay and pay - forever until you die. Some timeshare companies have such balls as to imply to your heirs that they are now liable for the timeshare fees forever and ever amen, which is, of course, illegal, but they do it, anyway.

Go on eBay and see how many timeshares are for sale for a dollar. No one wants these things, in most cases.

So you made a mistake - a critical one, and one that is nearly impossible to get out of. So you see an ad for a "timeshare resale" place that offers, for a $500 fee, to list your timeshare for sale! Seems to good to be true!

It is. You are out another $500. They list your timeshare for sale in a magazine that they publish - and maybe even put a few copies around. They did their part - there is still no market for these things.

So you see an ad on TV or online for "timeshare freedom!" They will relieve you of the burden of your timeshare! Maybe this is the answer.

Maybe. How was this deal pitched to you - in another loud television ad? In another unsolicited mailer? In a deceptive phone call? How the deal is presented often is all you need know.

This law firm website describes how some of these timeshare "relief" schemes work - or don't work. Note that the firm may be trying to sell their own services, and I do not recommend them one way or another - it is just an interesting read.

There are a number of different schemes to attempt to relieve you of your timeshare burden. One is to form a shell subchapter-S company and then have a number of people sell their unwanted timeshares to the shell company for a dollar each. The company then defaults on the obligations and after the timeshare companies have sued it and gotten default judgments, they bankrupt the subchapter-S company, leaving the timeshare people holding the bag.

Sounds like a great scheme to me! Oh, wait, the timeshare people are smarter than that:

Another form of a timeshare relief company is known as a “transfer company,” where the methodology is not to determine what the resort developers are looking to replenish, but to transfer the ownership of the interest away from the owner. In this case, “transfer to whom?” becomes the issue. There aren’t many people looking to acquire timeshare interests on the secondary market in light of rising annual maintenance fees. Some of the more imaginative timeshare relief companies create brand new business entities, corporations, and LLCs for the sole purpose of taking title to the unwanted properties. Recall that this method only applies when there are no mortgage or maintenance fee liens on the interest that would impair the transfer.

This new concept was effective for a while, but as the developers and property owners associations have learned the hard way, when the next maintenance fee bill comes due, these ‘no asset’ entities are defaulting on their obligations. Developers and property owners associations will no longer, generally speaking, permit transfer of title to either an unknown entity with no credit rating, nor to individuals who won’t agree to be credit checked as a condition of their acquisition.

So you see, there is no easy way out. If there was, people would be doing it.

How do you get out from under your timeshare? As far as I know, you can't. It is like the lady who asked about how to get out from being "upside-down" on a boat or RV loan. You can't. You can hand them the keys and have them tow the RV or boat away - and still have to pay the difference between the amount owed and the resale value of the item. For one friend of mine, this meant getting a home equity loan to pay the balance - not the way they envisioned spending their retirement, in debt.

Sure, you could declare bankruptcy, but that would mean losing a lot of other assets, and even then, the balance may be "worked out" by the court, so you would still have to pay - at least for a while, anyway.

Or take student loans - they survive bankruptcy, which means that even declaring bankruptcy won't change the balance on those loans one iota. A lucky few have managed to get themselves out of such debts - if the school was unaccredited, for example, the loans might be wiped out. Others have tried debt relief by working in public service for a number of years. I have a young friend working as a public defender for a decade to see if that will erase their student loans. All I can say is, if you go this route, make sure you cross the t's and dot the i's - one wrong form or misstep and your years of living below the poverty line will be for naught.

The best way of course, is to simply avoid these traps in the first place. You would think, in this day and age, that people would be smarter than that. After all, everyone has heard the horror stories about timeshares, right? Everyone knows someone who is hopelessly in debt with student loans and a degree in "communications" - right? We've all been schooled about these rip-offs. We know that payday loans, rolled over again and again will result in 300% interest and a one-way ticket to bankruptcy court.

Right?

Well, apparently not. Because even today, I hear from parents and kids about how they want to go to expensive Party-U and major in Useless Studies and borrow over $100,000 to do this. And there are cheaper ways to go, too. State schools and in-state tuition are far cheaper than "name" schools. And yet, I know a young person who eschewed a full scholarship at a decent school and decided instead to borrow huge sums of money to go to a "name" school, because a friend of theirs was going there.

OK, so that's some 20-something kid who doesn't know any better, right? But what about the timeshares? They still offer these "free cruises" where you are subject to timeshare high-pressure sales techniques. They call me on the phone and tell me I "won" a contest I never entered for such a cruise. They are lying to me, so I know right off the bat it is a ripoff. Actually, I know they are a ripoff before I pick up the phone, as they spoof the caller-ID to a 703 area code, hoping I will think it is a friend of mine and pick up. Any business relationship you enter into, based upon a lie, no matter how trivial the lie, will only go downhill from there.

Think very hard before signing any paper that is a long-term commitment. Better yet, leave your pen at home. The way our country is structured today, you can sign a piece of paper that will obligate you to a financial commitment for the rest of your natural life. Co-signing loans, timeshares, student loans - the list goes on and on.

I have no miracle cure for you if you signed such a commitment. And I am not sure such miracle cures exist - something-for-nothing has, in my life, always been an illusion. But maybe, by writing about these things and getting people to think about them, maybe I can help there - if just one person walks away from a timeshare seminar, it is a start.

Silence is the con-man's friend. People who fall for these crappy deals are often silent about them, because they know their friends will mock and ridicule them if they admit to making stupid bargains. Today, student loan debts or other debts are often a non-starter in the dating scene. Who wants to marry someone with $100,000 in student loan debt and $20,000 in intractable credit card debt? So people remain silent out of shame - and that silence allows another person to be suckered into the same kind of raw deals.

But what about political solutions? Surely Elizabeth Warren will save us! And yes, back in the 1960's, before usury laws were changed, bankruptcy laws were changed, student loan laws were changed, and gambling laws were changed, a lot of the rip-offs that ensnare the middle-class today were just not available for people to fall into.

If you voted Republican for the last decade or so, and are now ensnared in such a financial nightmare, it is kind of hard for me to feel sorry for you. All that "unnecessary government regulation" that would have protected you from raw deals is now long gone, and Warren's "Consumer Protection Agency" is under continuous Republican attack. The chickens have come home to roost, right in your house. How does it feel to be "trickled down" upon? Stew in your own juices - I do not feel sorry for you, you voted for this crap.

Maybe the next time a politician argues that we need to eliminate "unnecessary regulations" to "unleash the power of capitalism!" you should be more skeptical. Because in the last few decades, many of these repealed regulations have been financial ones, and the net result has been a lot of middle-class people have lost their pensions to these new "venture capitalists" and a lot more been ensnared by these raw financial deals that are difficult, if not impossible to get out of.

So again, welcome to the United States of Go Fuck Yourself. You have to watch your own bottom line, because today, companies make more money out of utterly ruining you, financially than with establishing a long-term business relationship with you. Leave your pen at home, think very carefully before you commit to anything and sober up - stop believing in something-for-nothing and believing in things that are convenient to believe.

Harsh advice, yes. But that's really all there is. If you still think there is a unicorn out there who can rescue you, man are you in for a world of woe!