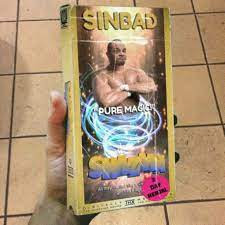

The problem with living too much in the present, is that you may not remember the past, or have a false memory of it. No, the "Shazam" movie did not exist, sorry. Nice photoshop, though!

In previous postings, I noted that it is not worthwhile to obsess about the past. Yet, many people spend their entire lives worrying about things that happened in high school or worry about their upbringing. People obsess about the past to the point that it prevents them from enjoying the present or the future.

People like to obsess about the past and wonder "what if?" they had only made different decisions in life. It is a futile game, simply because while your decisions are important, so are the decisions made by other people. Why obsess about decisions you made and not obsess about decisions made by others? Sure, maybe if you had turned left at the corner of Main Street and Pine, you would have never met your future wife. But suppose she turned the other way as well? Turns out, your choices are important, to be sure - but so are other peoples'.

People like to obsess about the past and wonder "what if?" they had only made different decisions in life. It is a futile game, simply because while your decisions are important, so are the decisions made by other people. Why obsess about decisions you made and not obsess about decisions made by others? Sure, maybe if you had turned left at the corner of Main Street and Pine, you would have never met your future wife. But suppose she turned the other way as well? Turns out, your choices are important, to be sure - but so are other peoples'.

Still others obsess about the future and fail to appreciate the present. I noted before that people who tailgate and drive like crazy are examples of people who are trying to live in the future. For them, the drive to work is something they've already accomplished in their minds, and they are already thinking about what they are going to do when they get there. The present is just an annoying experience to be endured in order to get to the next event in their lives. People end up frittering away their lives this way, always wishing for the next payday, or next weekend, or the next vacation, and not experiencing the present moments to their fullest.

But there is an opposite effect that occurs as well. People sometimes are so blinded by what's going on in the present they forget what happened in the past - often the very recent past - and never think about where trends are taking them in the future.

I mentioned before that, in my estimation, human economic memory lasts about 18 months. It's been almost a decade since the economy melted down in late 2008 and early 2009. A lot of people have forgotten this event has even happened, just as people during the height of the real estate bubble in 2007 forgot all about the real estate bubble of 1989. In fact, people have told me these bubbles never happened, or the way they remember it, Obama caused the economic meltdown in 2009. If people remember anything at all, it is to remember something that's convenient to them or something that's in line with their preconceived political notions. Just for the record, the economy melted down in the waning days of the Bush Administration - and it was George Bush, not Barack Obama, who signed the bailout of the banking industry. But that might collide with your preconceived notions or false memories, so just ignore that.

By the way, we should stop and address the Mandela Effect for a moment. People have collective false memories - or so they claim. Some folks claim they remember Nelson Mandela dying in prison, which is odd, because they "remember" this fact when he was still alive, and President of South Africa. Similarly, people "remember" the Berenstain Bears as being the "Bernstein Bears" or some other spelling. Or people claim that the comedian "Sinbad" played a genie in a fictional movie named "Shazam!"

These incidents illustrate how frail memory is - and how people can be convinced of memories that simply didn't exist. If you ever went to law school, you know about this - how "eyewitness testimony" is the least reliable form of evidence - and yet juries think it is the most reliable. "He musta' dun it! After all there were eyewitnesses!" But the reality is, unless you see someone you know in broad daylight, at close range, odds are, you can't "identify them in a lineup" like they do on Dragnet, after seeing someone running away on a dark night, at 100 yards. It simply isn't possible.

Similarly, memory is a tricky thing in general. Can you remember what you had for lunch yesterday? What about the day before? Last week? Last month? Yet people get on the witness stand and report they remember trivial events from months or even years ago. Even significant events - like major crimes - are hard to remember in the details. Our brains often embellish or embroider things to make them, well, more memorable.

Sadly, this illustrates how people can be convinced of almost anything, if you put it to them right. And people will believe any sort of bullshit, too. For example, the obvious explanation of "The Mandela Effect" would be that people are idiots, and can't remember one world leader from another, and often get their facts confused - if they knew them at all in the first place. Half of all Americans can't tell the difference between the Declaration of Independence and the U.S. Constitution. And few even remember the Articles of Confederation - the disastrous first attempt at forming a government before the Constitution was enacted in 1789.

But no, that never happened, according to some folks - I simply lived in a different parallel universe, where Nelson Mandela didn't die in prison, my dyslexia didn't prevent me from spelling "Berenstain" properly, and a faked-up image of a Sinbad VCR tape isn't the same as reality. And sadly, there are a number of websites out there (our Russian friends at work again?) who feed these conspiracy theories like someone fertilizing hothouse flowers. We all live in parallel universes! Shazam is real! And many folks often can't distinguish trolling and sarcasm from truth, or fiction from reality. To most people, perception is reality, and what they perceive, again, is what is convenient for them to believe.

In fact, if you want to know if you are perceiving something correctly, ask yourself if your perception results in something favorable to you. If so, odds are, you are mis-perceiving reality. That lease deal on that luxury car sounds awfully sweet, doesn't it? It sounds good because it isn't - you are just wanting it to be a good deal so much that you are ignoring reality and relying on a favorable perception. Down the road, however, reality will raise its ugly head and give you a good financial slapping around - that is, unless you want to retreat further and further into a fantasy world and blame all of your financial woes on Hillary or Trump, or whatever.

Yes, sometimes things actually do go your way. In fact most times, if you stop being a raging true believer. But whenever some good opportunity falls into my lap, I am very skeptical of it, and examine it carefully from all angles, to make sure it really is a good deal and not just my wishful thinking. Call me a pessimist, but I'm not the one with the underwater mortgage on an overpriced mini-mansion or the upside-down motorhome that will never be worth more than the balance on the note. I perceive reality a little better than that.

But getting back to our topic (once again, I digress), when planning for the future, people tend to look no further out than maybe 18 months, max. People tend not to see long-term trends that are readily apparent - or should be to anyone who thinks very carefully. For example, I wrote several blog entries, some many years ago, opining that the Chinese and Indian car industries are really the next big threat to the American car business.

In response to that comment, I received, of course, laughs and boo's from people claiming that products made in India and China are just plain junk, and that Americans would never buy them. Again, they don't remember saying the same comments they made about Korean cars a decade ago and Japanese cars 20 or 30 years ago.

When I was a kid, we had these cheap windup toys made in Japan and we thought they were cheap junk. We used to laugh at the term "Made in Japan" as meaning something that was complete crap. We would take apart these tinplate toys and find on the inside the metal was stamped with the name of an oil company or something. The toys were made out of scrap metal left over from making oil cans, that's how cheap they were. Ironically, those toys today - in pristine condition - are worth an awful lot of money as rare collectibles.

But it was true that, after the war, Japanese quality was pretty atrocious. But the Japanese buckled down and learned from each successive mistake and improved their quality incrementally every year. The first Japanese cars imported into the United States were rusty, tiny, underpowered pieces of junk that would likely kill you in the event of an accident. A friend of mine had a 1960's Honda 500 - it was a car barely larger than a phone booth, powered by a motorcycle engine.

Well, no one is laughing at the Japanese anymore. They dominate the American auto industry particularly in terms of automobile, not truck, production. Although Nissan and Toyota have done a very good job of building a worthy competitor to the F-150 and Chevrolet Silverado. It's only a matter of time before they start making heavier-duty vehicles for the American market.

Likewise, when Hyundai first started selling poorly made knock-off copies of crappy Mitsubishi cars in the United States - the Hyundai Excel - we all laughed at how cheaply made they were. But people snapped them up because they were priced so low at the time. And again we, saw the same pattern emerge, only much more quickly. At first, they started making cheap cars that were poorly made but learned from each mistake and incrementally improved their quality over time. Like Japan, they were forced to export in order to survive - it was a matter of national security to make quality products that would earn income for the country. And perhaps for South Korea, this was even a more dire need.

Likewise, when Hyundai first started selling poorly made knock-off copies of crappy Mitsubishi cars in the United States - the Hyundai Excel - we all laughed at how cheaply made they were. But people snapped them up because they were priced so low at the time. And again we, saw the same pattern emerge, only much more quickly. At first, they started making cheap cars that were poorly made but learned from each mistake and incrementally improved their quality over time. Like Japan, they were forced to export in order to survive - it was a matter of national security to make quality products that would earn income for the country. And perhaps for South Korea, this was even a more dire need.

While the Korean Auto industry is experiencing some minor hiccups right now, they do make a quality product. Their market share in the .United States is increasing steadily and Hyundai-KIA now has a factory right here in Georgia. I own a Kia Soul which is made in Korea and I can only I can attest to the fact that it's a car that is built like a small tank and screwed together very well. It is durable, cheap, and an incredible value compared to other cars on the market. The Koreans are the new Japanese.

Today we are laughing at the Chinese as making cheap crap. People use derogatory terms like, "It's made of Chinesium" to describe poorly-made Chinese products. And indeed, in the very recent past this was often the case - Chinese products are often cheaply made, or in fact defective from the factory. In the series of high-profile cases, some Chinese executives have been jailed or even executed for making fraudulent products such as baby formula laced with melamine.

But what took the Japanese nearly 30 or 40 years to accomplish, and the Koreans at least 20 years to accomplish, the Chinese will do it in 10 or less. Each successive wave of newly industrialized countries seems to speed up this process by a factor of two. Already, China is the largest market for America's largest car company, General Motors, makes more than half its profits in the Chinese market - and that's only owning 50% of their Chinese division.

What's more, open the hood on any "American" car and you'll find a plethora of Chinese-made parts. Ironically, the vehicles with the highest "American-made" content are Japanese. American cars have to rely on cheap imported parts to compete on price. It's nearly impossible not to buy Chinese parts for your car these days. The Chinese have been building up their own internal auto industry and auto parts industry and now are ready to export cars. And we have seen this already with Chinese-made cars on American roads, and Chinese car companies owning many international brands. As a recent Bloomberg article reports, the Geely group is prepared to launch Chinese-made cars made in Europe with the eventual goal of bringing these cars directly to America under Chinese brand names.

And people will laugh at them and call them Chinese-made junk. But others will look at them as a great value and snap them up and realize they have decent quality at a low price and are a better value than some American-made vehicles. And before long, there will be Chinese auto plants in the United States and people will not even blanch seeing a Geely or other Chinese-branded car cruising down the road.

And then India is not far behind. Tata Motors is one of the largest car makers on the planet and they've already acquired some European auto brands. And they are already exporting vehicles made in India to the American market under American car names. Given the productivity of the Indian people and the shrewd engineering skills of Indian engineers (which I have witnessed firsthand) I have no doubt that they will be able to produce quality vehicles at a very competitive price for export.

Again, human economic memory is 18 months, tops. General Motors and Chrysler went bankrupt back in 2009 because they were producing nothing but huge gas hog vehicles such as trucks and SUVs, when gasoline shot up to well over $5 a gallon. People fled from these vehicles to small and more efficient cars which the big-3 weren't even making.

And by the way, that was the second time Chrysler declared bankruptcy - they did it back in 1980 under Lee Iacocca (or maybe that was in a parallel universe?) and recovered by building a small front wheel drive car known as the K car. And since then, Chrysler has gone through many metamorphosis including being owned by Mercedes-Benz then sold then bought by Fiat in bankruptcy. And since then Fiat has been doing nothing but trying to unload Chrysler and or sell its entire organization to some other company. This does not bode well for the long-term strength of Chrysler Fiat.

But again, human memory being what it is, people don't remember these things or refuse to remember them. Today, there's an orgy of large SUV and truck buying. People assume that since gas prices are fairly reasonable at the present time that they will continue to be reasonable for the rest of their lives, forgetting that the price of gasoline routinely spikes. In fact, if you are a fan of conspiracy theories you can concoct a very good one that perhaps the oil companies lower prices intentionally to lure people into buying gas hog vehicles such as SUVs, pickup trucks, motorhomes, power boats, and whatnot and then once the market is saturated with these vehicles, they can jack the price of gasoline through the roof.

But we don't believe in conspiracy theories here. A far more rational explanation is it when gas prices go down, people - being lazy and weak - indulge themselves by buying gas-hog vehicles of all sorts. Hence the boom in RV sales and pickup truck sales and SUV sales today. These low gas mileage vehicles drive up the demand for gasoline, which in turn raises prices, which creates this endless cyclical loop. And it is a loop I have experienced at least a half a dozen times since I was old enough to drive - starting in 1973 or thereabouts with the initial Arab oil embargo.

And the funny thing, we are already seeing oil prices go up to $70 a barrel and gas prices edging up towards $3 a gallon or more. It doesn't take a rocket scientist to say that gas prices eventually will go up to $5 or more a gallon and that we will experience another gas crisis in the not-so-distant future.

But if you say that and it doesn't happen in the next 20 minutes, people will laugh at you and discount what you have to say. I noted early on in this blog that it looked like companies like Radio Shack would go out of business. And eventually Radio Shack did, although it was bought out by a private investment company, who tried to make a go of it, and then it went out of business a second time.

I also noted a decade ago that colleges and universities could be the next to go bankrupt as they are basically selling an overpriced product to a shrinking market. If you look at the demographics, fewer and fewer people are graduating from high school, and, college is becoming less and less of a cost-effective proposition. And of course, it didn't happen 10 minutes after I said this, so people said "You don't know what you're talking about!"

But in the last few months - and indeed even years - you've heard about small liberal arts colleges going belly-up in this new era. They have staggeringly high tuition rates and are offering an education which many people feel is obsolete or is it less used to them and finding a job.

The Sears example is also illustrative. A number of prognosticators, including myself, I predicted the demise of Sears. And these predictions have gone back more than a decade. And yet Sears continues to soldier on like a wounded duck. In the latest development, the CEO of the company, who holds most of the company's debt and is the largest shareholder, had the company sell him - at a very advantageous price - most of its remaining assets. The company went bankrupt, and since he was the largest debtor, he now owns the tattered remains, which he is stripping off for personal profit.

But since Sears didn't crash five or ten years ago, some people still kept buying Sears stock. They looked at spikes in earnings caused by sales of assets and assumed that the company is back on track or that Mr. Lambert's "Shop My Way" program was actually gaining traction.

And we see this in the overall stock market - people buying stocks based on quarterly profit reports, not based on long-term trends and viability. Personally, I think it's foolish to buy a stock just because you heard this profits went up for one quarter. That can be rather inaccurate metric.

Recently, General Motors announced it would no longer release monthly sales reports but rather go to quarterly reports. And the reason why is what I was just talking about above. Last month's sales report showed a spike increase in sales because of an anomaly in the calendar put an extra weekend into April. Plus, sales for March and may ended up being lumped in the April category which showed a double-digit increase in sales over last year. But in reality, they didn't sell that many more cars and trucks, it's just they were counted differently for that month - which of course affected the sales reports for the preceding and subsequent months. Buying or selling stocks based on the monthly reports or even quarterly reports is short-sighted. But again, people don't like to think long-term.

It is the same reason why the UAW went out on strike. GM is doing well - for a few quarters - so why not share the profits? They've forgotten already what happened in 2009, when the bloated cost structure bankrupted the company. They've forgotten already how the bloated cost structure caused GM to lose market share for the last 50 years. All they see is today, and maybe a few months into the past - an alternate universe past, apparently.

It is the same reason why the UAW went out on strike. GM is doing well - for a few quarters - so why not share the profits? They've forgotten already what happened in 2009, when the bloated cost structure bankrupted the company. They've forgotten already how the bloated cost structure caused GM to lose market share for the last 50 years. All they see is today, and maybe a few months into the past - an alternate universe past, apparently.

It's also like this pattern also appears with other types of bubbles such as gold and Bitcoin. I correctly predicted the obvious - that gold and Bitcoin would peak and then crash. And when I said this, and it didn't crash the very next day, people laughed at me and said I was an idiot. But eventually gold peaked, and it has gone far down in value in as yet to recover to that peakl. And Bitcoin crashed even more quickly - and it is unclear whether it'll go down further or not at this point.

But that is the nature of living too much in the present. People tend to look at conditions that surround them at the moment and assume these are static conditions that will be there for all time. They have no memory of things changing in the past and if you try to tell them about trends in the future, they discount them if they don't happen within a few minutes after you said them.

The key to predicting the future is to look to the past. After you've experienced several gas crisis, you tend to expect ones in the future. When you've lived through two housing bubbles, you can more accurately predict the next one. You start to learn that when things get too expensive, people stop buying. You start to see the feeding frenzy when people get desperate to buy things and will pay any price - and you know what the outcome will be in the end.

Or, you can neglect the past and not learn from past mistakes. Or worse yet, you can believe in a false memory of the past and thus learn all the wrong lessons when you apply them to the future. Or, as most people do, simply continue to live in the present and ignore the past and the future. While it is important to live in the moment and cherish the present, one should ignore the past or try to rewrite it to suit a present narrative.