People have tried to monetize every damn thing, which tells me the market is overworked.

Psst! - want to buy a chunk of art?

NFTs were just another sign of the end times - another way to "invest in nothing" other than an ugly JPEG of a monkey that, as it turns out, you don't even own. You bought the right to..... nothing.

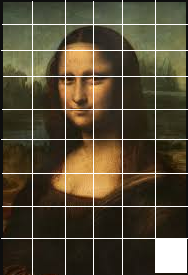

That was bad enough. Another scheme we are seeing hyped online (as an advert in YouTube channels) is a scheme to invest in "fine art." You've no doubt heard about those auctions where rich bastards buy and sell famous paintings for millions of dollars. They're making money hand over fist! Well, as we shall see, not exactly. And the art world is full of fraud, and I'm not just talking about forgeries, either.

Some brilliant guy came up with the idea of allowing us "little people" to buy a share of a famous painting, such that, we too, can play with the big boys and make mucho moola in the world of art.

There are a number of problems with this idea. To begin with, the only people who are guaranteed to make money from this are the people who run the scheme - who no doubt collect fees on each end of the transaction. But you and me? A famous painting can sell for millions at one auction and then sell for far less a few months later at another auction. Increasing prices are not always assured.

Adding to the problem are shill buyers. A painting goes up for auction and the owner hires a shill to bid up the price to "prove" that the painting is "worth" that much. You can do this a number of times, and the "value" of the painting goes up accordingly. It is only when you really have to sell it to a real buyer and not one of your friendly shills, that the real price is determined.

So you and I, knowing nothing about the art world, art, art auctions, and the rest of it, buy a "share" in some painting by an artist we never heard of (but the company selling shares tells us is "going places") and it is valuable because it sold at auction a year or so back for a million plus. But was that a real auction or just some shill bidding? We have no way of knowing.

Not only that, but what happens to the painting? It goes into a vault, and is no longer art, but a talisman of art. The point of art is to look at it, enjoy it, and cherish it. You can't do that when you own a "share" of a painting as an "investment" - it reduces art to a commercial transaction, nothing more. The art is no more than a gold bar, or a token for a crypto coin - worth whatever someone else is willing to pay for it later on - nothing more. You have to hope the greater chump appears to buy it down the road. A chump shortage could be a disaster!

In a way, buying a share of a painting you never see - that no one ever sees except on the auction easel - is akin to buying an NFT. You are buying a pig in a poke. And in terms of liquidity, you have to hope some other chump is around to pony up cash to buy your share in a painting later on, if you discover you need to cash out for practical reasons.

The value of art is purely speculative - like NFTs. It can be worth millions one day and worth hundreds the next. There are no guarantees, and there is no way for the "investment" to "earn" money (e.g., by renting out the painting) or pay dividends. It is pure speculation that someone else will pay more later on.

Some folks claim it is even worse than that - that the company selling you the shares might not even own the painting in question. I have no data on that, other than to say that it seems like a virgin industry without a lot of regulation. It would be fraud, of course, to sell shares in a painting you don't own, but then again, whadda ya gonna do? Sue them? They may be headquartered overseas. You would have to hire a lawyer to get your money back - if it could even be found. And no, the FDIC doesn't insure these things.

One site claims they have sold some paintings and made 17% rate of return. Annualized? Or overall? Because 17% over three to five years isn't all that great. Even in one year, not all that great, considering the risks involved. The company takes a 20% cut of the profits, though. Like I said, the only one guaranteed to make money on this is the company selling shares.

No, there is nothing to be gained here, I think. It is just another scheme to separate the great unwashed masses from the few shekels they managed to keep from slipping through their fingers.

Not recommended! Just another sign of the end times.