Robert A. Heinlein used the term TANSTAAFL in many of his Science Fiction novels to describe the concept of "There Ain't No Such Thing As A Free Lunch!" in shorthand. It is a sound principle to apply, but many folks fail to grasp this simple economic theory.

What do people mean when they say, "There ain't no such thing as a free lunch?" It is a puzzling expression to many folks today. But historically, free lunches were used as a means of tricking people into spending more money than they intended to. And of course, these "free lunches" weren't free.

A Brief History of "FREE LUNCH"

Back in turn of the last Century, many working people in major cities such as New York would break for lunch at a local bar or tavern, and have a beer and a sandwich as a noontime meal. Competition among bars became fierce, and in short order, many were offering discounts on food, hoping to attract more of the lunchtime crowd.

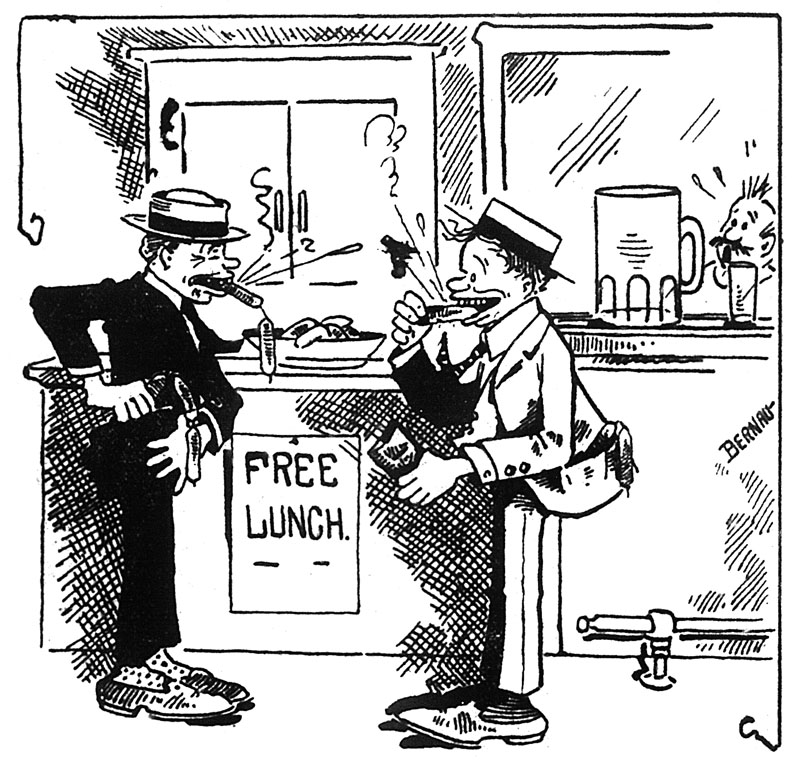

This marketing trend culminated in the FREE LUNCH offers. Photos from the era show bars with large FREE LUNCH signs prominently displayed in the windows. If patrons would buy a beer or two, they were entitled to a free lunch. A great deal - or so it seemed.

A free lunch of sausages didn't cost the barkeep much, and since patrons were required to buy a beer, the cost of the lunch was simply folded into the cost of the beer, which in this cartoon is rather large!

In reality, the lunch was not free. To begin with, the bar usually required the patron to purchase a beer to obtain the lunch. And even if such a purchase was not required, the wait time to get the "free" lunch was so long that most thirsty patrons would order one. As you might expect, the cost of the "free lunch" was folded into the serving price of the beer.

Bar owners also knew that lunch hours were short, so that by carefully controlling the amount of food served to patrons, they could be certain that most would still leave hungry, as they had to return to their jobs by a certain hour. So delays in serving food often worked to the bar owner's advantage.

Modern Usage of "FREE LUNCH"

People quickly realized that the "Free" lunch offered by these bars was anything but free. The cost of the lunch was simply folded into inflated beer prices, and the resulting "lunch" was often stingy and small. The term "Free Lunch" quickly evolved into a term for any come-on or other "deal" which turns out not to be such a deal after all.

But as used by Heinlein and others, the term takes on a more profound meaning. As applied as a market theory, TANSTAAFL is much more than a de-bunking of come-ons and promotions. Rather, this term defines a basic theory of economics - that every good and service in the economy must be paid for by some party at some time, and that nothing is, in reality, "Free" at all and can never be.

In other words, everything in our economy has a cost, and that cost must be borne by some party somewhere in the economic chain. We cannot create wealth from nothing, nor can we spend money that we do not have. While this seems axiomatic, it is surprising not only how ordinary people believe in the free lunch, but also how many government workers and politicians believe in it as well.

Many folks want to believe they can get something for nothing. They like ideas such as the "100 mpg carburetor" - that the oil companies are supposedly suppressing. Or perpetual motion. They like the idea of wealth without labor, of violating the law of conservation of energy. In short, they want something for nothing. And it is this attitude that gets them into trouble.

The term TANSTAAFL also boils down to the concept that "The more complicated you can make a financial transaction, the easier it is to fleece the marks."

Taking our original FREE LUNCH concept as an example, most people would not go into a restaurant if they were told what the overall cost and portions would be, as set up by the bars offering "Free Lunch". Most consumers would say "that is no bargain. For the amount and quality of food served, the price is too high!"

But few consumers actually do this, as they are not presented with that apparent choice. What they perceive as the choice is something for "Free" and, oh by the way, you have to buy a $10 beer to get it. Dangle the word "Free" in front of most consumers, and they salivate like Pavlov's dogs.

The concept of FREE LUNCH played upon the irrational emotional belief that you can get something-for-nothing. And by making the financial transaction complicated and indirect (adding the food cost to the liquor bill and making the food 'free') most consumers were not even aware they were being fleeced. "Hey, I got a FREE LUNCH out of the deal - I came out ahead!" they would say.

The best cons in the world are where the Mark believes that he is getting away with something.

Are You Falling for Free Lunch?

The concept of the Free Lunch is alive and well today, and you may be falling for it without even knowing it. In fact, as noted above, when the FREE LUNCH concept is properly applied by marketers, the consumer (the mark) doesn't even know he's been had.

Think you are savvy enough to avoid the FREE LUNCH trap? Well, in the last few years, have you leased a car, mailed in a rebate coupon, used airline miles, or participated in some sort of 'buyer loyalty' program? If so, chances are, you fell for the "Free Lunch" gambit.

Car Leasing - the Big Free Lunch that Costs a Lot!

Leasing a car, as I have noted before, is one of the most expensive ways to go about owning a car. Many consumers labor under the misconception that they do not own the car, but are renting it. But a lease really is just an agreement to sell you a car and then buy it back later on - on very unfavorable terms.

Leasing deals are horribly complex, and the basic terms of the deal, such as the purchase price, resale price, and interest rate, are often buried in the documents or glossed over by salesmen who sell the consumer on "monthly payment".

The "FREE LUNCH" or something-for-nothing idea in leasing is the concept that you can have "more car" for a "lower monthly payment." The reality is, by ignoring actual cost of ownership, the consumer ends up paying the highest price possible for transportation - and this is before we factor in things on the "back end" such as excess mileage and "wear and tear" on trade-in.

But I've argued with many a consumer who has had that glossy, wild-eyed look in their face, convinced they are getting a "great deal" by purchasing "only that part of the car they want" - the horrible initial depreciation. You can't reason with a raging true-believer.

Now granted, every ONCE IN A WHILE, someone comes out ahead in a leasing deal. Just as once in a while, someone sneaks in to a bar and cadges a FREE LUNCH without buying the requisite $10 beer. But it doesn't happen often, and it won't happen to you, and figuring on it happening is a sure way to go broke.

Airline Miles - Free Lunch for twice the cost!

Airline miles are another area where the concept of "Free Lunch" has been taken to an extreme. Originally, airline miles were used as a way to get passengers to book on a particular airline. Back in the 1960's and 1970's, before deregulation, most airplanes flew half-full (or half-empty, if you are a pessimist). So giving away empty seats literally cost the airline little or nothing.

And since air travel was so prohibitively expensive, most travelers were businessmen traveling on business. They had a choice in airlines, but the cost of the ticket was paid by their employer. If they could specify which airline, they could reap the reward in terms of airline miles, which could later be used for a family vacation.

And mileage rewards were generous, too. It only took a few flights to obtain a "free" flight anywhere in the USA. Like I said, those empty seats cost the airline nothing, so they gave them away to get the paying customers.

The Government and many businesses tried to cut back on this trend, by forcing employees to turn over their miles to the government or business. These miles were outright bribes, frankly, and the government had every right to insist they be turned over. The IRS even explored taxing these as income.

But the motivation to do these things waned as deregulation shook up the airline industry. One of the first things to suffer was the airline miles programs. Overnight, the number of miles needed to get a "free" flight was doubled, and then doubled again. Then other, little things were added to chip away at this "free" item. Miles would expire if not used. Fees were charged for redeeming miles for tickets. And most importantly, severe restrictions were applied to prevent you from actually using the miles in an really useful way.

At the same time, airline miles were marketed to other parties as an incentive for credit card companies and other merchants unrelated to the airline industry. Airline miles were no longer the carrot used to lure the business traveler, but rather a come-on to sell credit cards and other services.

Airline miles were never "Free" - even back in the golden heyday of the 1970's. Your employer paid for them in most cases. And even if you were buying your own tickets, the "free" miles were folded into the cost of the ticket itself. Nothing is free.

Today, they are even less free. Credit card companies buy miles from airlines and then charge merchants who process the credit card transactions an extra fee. VISA in particular, has been "sticking it" to merchants as of late, charging rather steep fees for processing credit cards that use airline miles. Problem is, merchants have no way in advance of telling whether the card used is a "rewards" card, so they are stuck with the expense, which in turn is folded into the cost of doing business. In other words, we all pay for it. Nothing is free.

And airlines no longer have all those empty seats to give away. Full flights are the norm today (and so are low airfares). So the severe restrictions on using miles to buy tickets were implemented to prevent people from taking up salable seats.

Upgrades are pushed as the best way to use airline miles. Oftentimes seats in first class remain unsold, and offering a "miles" customer a seat up front in exchange for miles is a neat way to give away something that was unsold anyway - and free up a seat in coach for another paying customer.

Note also that most "miles" credit cards charge exorbitant rates - 20% or more. While you may have the discipline to "pay off the balance every month" nearly 70% of credit card users do not (and most lie about it rather than admit the painful truth). And even if you pay off your balance every month, most charge annual fees of $100 or more.

So what is the alternative? Well, for the casual flier (and even business flier today) the use of airline miles makes little or no sense. Since these miles "expire" over time, unless you really fly a LOT, you will not end up accumulating enough miles for an upgrade or free ticket. So the best strategy is to shop for airline seats based on cash cost, not on loyalty to a particular airline.

If you find yourself flying the same airline a lot, then sure, it makes "sense" to enroll in the loyalty program. Chances are, however, that you'll use those miles for upgrades to first class. The restrictions and limitations on free tickets are so severe that it is nearly impossible to use them.

For credit cards and other services offering "free miles" I would suggest walking away. You pay for these miles in higher interest rates. And if you end up carrying a balance for even a few months at 22% interest, well, you've paid for your "free miles" many times over. Shop for a credit card based on lowest price - lowest interest rate, no fees, etc.

Again, when a simple financial transaction (buying an airplane ticket, borrowing money) can be made complex, the overall real price can be better obscured to the consumer. That is the whole idea behind FREE LUNCH. Make the "mark" think he is getting something for free, when in fact he is paying nearly twice as much for it. It is a neat trick.

Rebates, Coupons, and Other Rewards Programs

The rebate is the most curious financial instrument devised by man. If you are like me, you wonder "why not just lower the price? That would be so much simpler!" But of course, simplicity is not to the advantage of the marketer. The rebate makes a simple financial transaction more complicated, and thus the real cost can be obscured.

For many folks the idea of something-for-nothing has such a powerful hold that they cannot shake it - ever. So you offer a "rebate" and they buy. Nearly 70% of people buying products with rebates never bother to fill out the forms and mail them in. And of the those who do mail them in, many never receive the rebate because of alleged "errors" in the paperwork. Since the rebate checks are mailed out months afterwords, many consumers completely lose track of the transaction and never realize they never received their rebate - or care, for that matter.

Rebates can be costly as well. For example, one fellow purchased a generator with a $100 rebate. He mailed in the coupon and the original UPC code which he cut off the shipping carton. He found out later on that the generator didn't work. Well, with the UPC missing from the carton, he could not return it to the store for a full refund. His only recourse was under the warranty, which had expired.

Other rebates require such onerous paperwork requirements as to never be practical. A $4 rebate on a bottle of Vodka, for example, requires the consumer to soak off the label and mail it in. How many consumers want to serve their guests in label-less bottles - or have the time and inclination to soak off a label, fill out a form and spend 43 cents on a stamp for a measly four bucks? Not many, to be sure.

Couponing is another area where the dangled "FREE" tends to blind consumers. Coupons are not a bad deal if they offer a discount on a product you intended to buy all along. But in many instances, consumers change their buying preferences based on coupon availability. And oftentimes, the "brand name" item, even with the coupon discount, is more costly than "store brand." On average, you'll come out ahead buying store brands or being more price conscious, than spending hours clipping coupons.

Back in the day of "double coupons", they were a great deal. And a savvy consumer who obtained the coveted manufacturer's coupons, could literally go out the checkout paying little or nothing for groceries, on occasion. However, such stunts were just that - stunts - and often performed before television cameras to sell consumers on the idea of couponing.

Again, nothing in life is "Free" and the cost of coupons is folded into the cost of the other groceries you are buying. And since in many instances, a "brand name" product with a coupon is still more costly than the store brand, the savings are illusory. In many instances, the company is still making a profit with the coupon - and often the cost of the coupon is factored in.

"Instant" coupons are an extreme example of this idea. Why bother to price an item and then attach an "instant coupon" to it to lower the price 50 cents? Again, the idea is to dangle that word "FREE" in front of you, so you won't notice that the competitor's product is actually a better deal.

Rewards programs work the same way. The local boating store offers "rewards coupons" if I buy a certain amount of merchandise every month. Rather than just lower my bill by the same amount, they proffer these coupons instead. On more than one occasion, I've let a coupon expire, because I had nothing I needed to buy there. On many more occasions, I've gone back to the store to "buy things" because a coupon was about to expire. The $25 coupon gets you in the store, where you spend $100 on stuff. While it may seem like you are getting $25 for "free", you are paying for it in terms of the inflated cost of other goods. And if you are buying things you don't really need.... well, where's the savings in that?

A better deal is to find the things you want at the lowest possible price - which often means online or at a competing store. Of course, if you find yourself having to buy a lot of products at a particular store (for business, for example) then it makes sense to sign up for these programs. But as with the airline miles, oftentimes these "rewards" are kick-backs to people purchasing items for their employers. The secretary who buys office supplies for the company at the supply store is certain to cash in those "rewards" coupons on things for herself (which is one reason these supply stores carry more and more non-office supply items. A secretary has no need for another stapler at home).

Cash For Clunkers - Government FREE LUNCH

The reality is that you probably can't avoid FREE LUNCH entirely these days, as every financial deal, it seems, has some sort of "freebie" worked into it, and unless you can work that coupon or rebate, you can't get the best deal. In some instances, you have to hold your nose and play these games.

But often, if you look hard and crank the numbers, it turns out the FREE LUNCH is not such a bargain after all. For example, the CARS (so-called "Cash for Clunkers") rebate of $4500 sounds like a heck of a deal, until you break down the actual costs involved.

To begin with, they are not giving the money away. You have to turn in a working car that has been registered and insured (by you) for the last year. Even the cheapest running car is worth maybe $500, so the $4500 "rebate" is really at most $4000. If your car is worth more than that, well, then the rebate is worth accordingly less.

For example, I have a 15-year-old pickup truck worth maybe $3000 on a good day. Is "cash for clunkers" a good idea for me? Well, the actual value to me is only $1500, as I would have to turn in a $3000 car to get the rebate.

UPDATED June 2015

And yes, some manufacturers are offering to "match" the rebate. But in order to do so, no other offers can be applied, and the "match" comes off the sticker price. Most new cars are horribly overpriced on their sticker, and you can easily talk down a dealer $4500 without trying. So this "matching" is not really such a deal after all.

And finally, in order to trade in your clunker, you have to buy a new car with higher gas mileage. So if I wanted a replacement pickup truck, well, I'd be stuck with a Ford Ranger or some small truck that would not pull my trailer.

A better deal, as in the past, would be to sell my existing truck through Autotrader and then buy a late model low mileage used truck. The overall cost would still be less, even without the $4500 "cash for clunkers" rebate.

The news stories are full of how people traded in their gas guzzler and "got a new PT Cruiser for only $9000!" But if you think about it, they paid over $10,000 for that car by trading in a $1500 "clunker." And the resale value on a PT Cruiser is not very high ($6000 to $10000). So in effect, they ended up getting very little of a "bargain" at all.

TANSTAAFL! - There Ain't No Such Thing As A Free Lunch!