If you make enough predictions, at least one of them will seem eerily prescient. But that's only if you don't look at all the other predictions that went wrong.

I was looking at Wikipedia's List of Confidence Tricks, and this one entry jumped out at me:

Baltimore Stockbroker / Psychic Sports Picks[edit]

The Baltimore stockbroker scam relies on mass-mailing or emailing. The scammer begins with a large pool of marks, numbering ideally a power of two such as 1024 (210). The scammer divides the pool into two halves, and sends all the members of each half a prediction about the future outcome of an event with a binary outcome (such as a stock price rising or falling, or the win/loss outcome of a sporting event). One half receives a prediction that the stock price will rise (or a team will win, etc.), and the other half receives the opposite prediction. After the event occurs, the scammer repeats the process with the group that received a correct prediction, again dividing the group in half and sending each half new predictions. After several iterations, the "surviving" group of marks has received a remarkable sequence of correct predictions, whereupon the scammer then offers these marks another prediction, this time for a fee. The next prediction is, of course, no better than a random guess, but the previous record of success makes it seem to the mark to be a prediction worth great value.

For gambling propositions with more than two outcomes, for example in horse racing, the scammer begins with a pool of marks with number equal to a power of the number of outcomes, and divides the marks at each step into the corresponding number of groups, thus insuring that one group receives a correct prediction at each step. This requires a larger number of marks at the beginning, but fewer steps are required to gain the confidence of the marks who receive successful predictions, because the probability of a correct prediction is lower at each step, and thus it seems more remarkable.

The scam relies on selection bias and survivorship bias and is similar to publication bias (the file-drawer effect) in scientific publishing (whereby successful experiments are more likely to be published, rather than failures).

Several authors mention the scam: Daniel C. Dennett in Elbow Room (where he calls it the touting pyramid); David Hand in The Improbability Principle; and Jordan Ellenberg in How Not to Be Wrong.[45]

Ellenberg reports often hearing of the scam told as an illustrative parable, but he could not find a real-world example of anyone carrying it out as an actual scam. The closest he found was when illusionist Derren Brown presented it in his television special The System in 2008. Brown's intent was merely to convince his mark that he had a foolproof horse race betting system rather than to scam the mark out of money. However, Ellenberg goes on to describe how investment firms do something similar by starting many in-house investment funds, and closing the funds that show the lowest returns before offering the surviving funds (with their record of high returns) for sale to the public. The selection bias inherent in the surviving funds makes them unlikely to sustain their previous high returns.

The last lines were interesting, and something along the lines of what I was thinking earlier - never confuse being lucky with being brilliant. On Wall Street, there is always going to be a hot-shot trader who always makes the right picks - it is predictable in a sea of thousands of traders. But eventually, he makes the wrong pick and people scratch their heads and say "he's lost his touch" when in fact he never had a "touch" but was just flipping a coin 100 times and coming up heads more often than not. He is just a statistical outlier.

I mentioned this effect with regard to futurists such as Faith Popcorn - she makes hundreds of predictions and then cherry-picks which ones were "right" (or modifies them to fit the actual outcomes, hammering a square peg into a round hole) and then can say she "predicted" a trend.

They call it selection bias, and quite frankly I guess I didn't explicitly understand it until I read this. It is like the Gambler's Fallacy - something I didn't fully appreciate even when I was taking a course in probability and statistics. If you flip a coin 100 times and it comes up heads each time, then surely the probability the next flip is "tails" has to be greater than 50:50 - right? Wrong. (What it really means, is you need to examine that coin carefully!) Each flip is independent of the other. The odds are 50:50 for each flip, for a fair coin.

Investing without understanding selection bias and the gambler's fallacy is risky - and probably why I lost money on my early investments.

The part about investment funds was particularly interesting - every brokerage house is going to have one fund that does really well, and they will advertise that. That doesn't mean it will continue to do well. Meanwhile, they close the funds that lost money, and start new ones, hoping one of those will also strike gold. Seems like the small investor can't win either way.

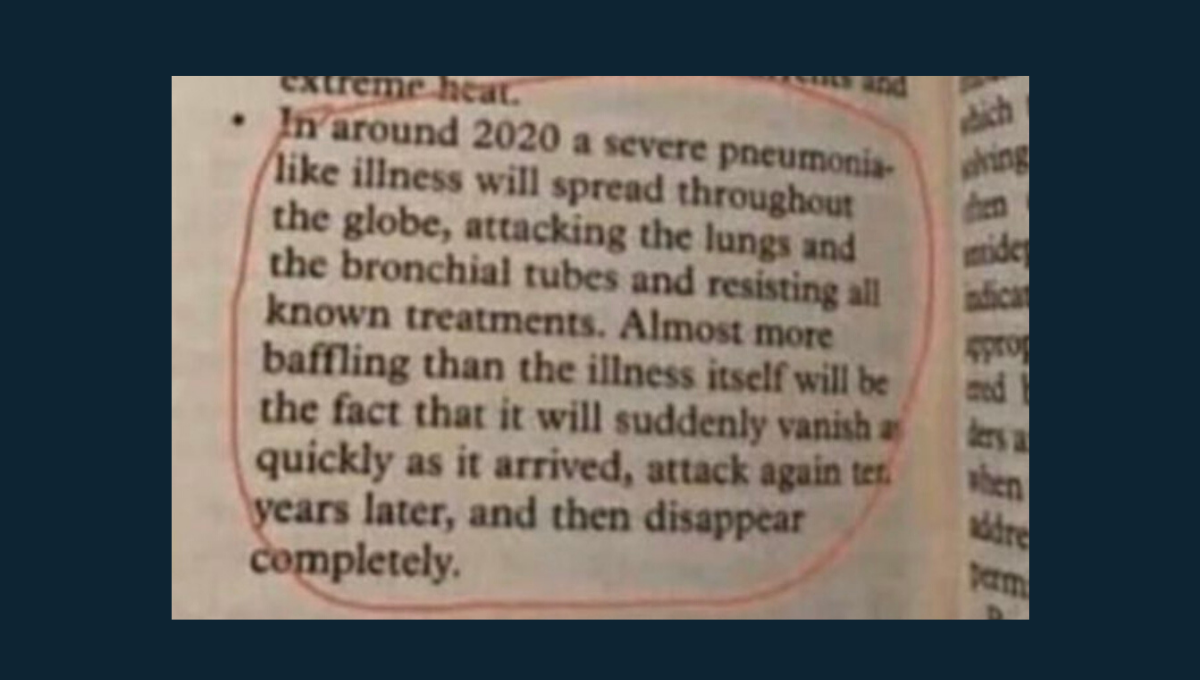

The quote above is from a prognosticator who claimed to have psychic powers. It sounds really scary and accurate - how could she have known? Well, not long before she made the prediction there was the SARS epidemic, and it was a pretty safe bet that epidemics would happen in the future. Epidemiologists, who use more than psychic powers, have been saying all along we were overdue for some sort of epidemic like the Spanish flu, as these things do strike periodically, and we still do not have a handle on controlling viruses.

Simpsons predicted it - or did they?

You might as well say The Simpsons predicted it, which they sort of did with their "house cat flu" episode. or South Park with their SARS episode.

South Park predicted it, too.

Or maybe Dustin Hoffman predicted it.

Even Hollywood is in on the act.

But of course, Hollywood predicted a mega-volcano, alien invasion, a new ice age and even six ravaging episodes of Sharknados. None have come to pass - yet. (Cue hoo-doo music).

Predicting the future is not an exact science - in fact, it is the hardest thing to do. But if you predict everything, or at least make a whole lot of predictions, well some of them will come true, and you will be seen as a psychic genius or futurist. Just don't talk about the things that didn't quite work out.

In a way, it is like end-times theology, which in its current form is a relatively modern invention. People have been taking one of the most obtuse books in the Bible - Revelations - which by all accounts was written by an insane ex-Rabbi, and then projecting the vague and weird predictions onto current events - for over a Century now. The Anti-Christ? Surely he has to be Hitler, or Stalin, or maybe Obama or Trump - right? You fit the data to the theory, rather than the theory to the data, and like any good conspiracy theory, you can twist things around to show they match up, kinda sorta.

So what's the point of all this? Nothing I guess. I just thought it was interesting. But maybe I can learn some things from this:

1. Selection bias is a real thing - we tend to see people as "winners" in the marketplace when often they are little more than lucky. They may have some insights, but also may be statistical outliers, too.

2. Prognosticators and futurists can always claim they were "right" about things, either by just lying about it (who is going to spend the time and effort to check?) or by selectively picking from among thousands of predictions, the few that came close to being true.

3. Spending money on a psychic reader is just stupid, even if just for "entertainment" purposes. These folks are crooks and con artists - just stay away. If you believe in that sort of thing, you life is going to be one difficult trial after another - which probably will send you back to the psychic for more "advice"!

Since we can't accurately predict the future (and thus buy the winning lottery numbers) the only realistic thing to do is diversify your portfolio, put aside money (instead of trying to leverage small investments in to big "wins") and pay down debt over time.

Not sexy, is it? You could never sell an investment book or a futurist book with such boring advice.

UPDATE: see my posting about diecast racing. It's a classic example of selection bias. With a color commentary, the authors of those videos make it sound like there's actual drivers of the diminutive cars. But in reality the car that advances up through the ranks is the one lucky enough to win each race which is largely a probability event.

Nevertheless, you'll find yourself rooting for one driver over another. Fun to watch!

UPDATE: see my posting about diecast racing. It's a classic example of selection bias. With a color commentary, the authors of those videos make it sound like there's actual drivers of the diminutive cars. But in reality the car that advances up through the ranks is the one lucky enough to win each race which is largely a probability event.

Nevertheless, you'll find yourself rooting for one driver over another. Fun to watch!