Medicare plans vary wildly from State to State!

The more I learn about Medicare, the more confused I become. I finally signed up for a Plan G supplemental with BCBS and a Part D with Humana. We'll see how well that works out. Frankly, it is a crapshoot, I think.

A reader from the Commonwealth of Massachusetts writes:

When you first posted about your medical condition, I thought that perhaps it was Parkinson's but I did not throw that out there as I did not want to be a Debbie Downer. I am happy to see that the medication is working for you and that you are back blogging.

Here in Massachusetts, when I signed up for Medicare I went to a SHINE counselor (Serving the Health Insurance Needs of Elders). In Georgia this program is called SHIP.

In Mass I could actually become a SHINE volunteer and be given a shitload of training so I could help people with Medicare. (which would also really teach me the ins and outs) they pay some people, who knows - could even be offered a job. In Georgia, I believe you can become a SHIP volunteer and get the training but I did not check.

At any rate when I signed up I went for Original Medicare Blue Cross Blue shield with the Supplement Medex Bronze and Part D. Since I am on practically no meds (one low dose BP) the SHINE counselor told met to get online, punch in that med and it tells you what all the plans go for and to sign up for the cheapest plan. Every year during the enrollment period you can change plan D based on your meds. The cheapest plan serves as a placeholder for me -ie. penalties if you don't have part D.

Most times it is cheaper to buy the prescriptions I need using GoodRX or other online site and

take the coupon to CVS. If I order it at CVS they jack up the price and bill the insurance, and

it still costs me more.

Its sort of like the eyeglass thing where they take you over to the eyeglass side and want to sell you $500 eyeglasses less the $150 medicare payment=$350 cost but buy online and you get the glasses for under $150 fully paid for. What a shell game.

The reason I chose Blue Cross Blue Shield with Medex was that:

1) I can see any doctor who takes Medicare just about all of them and I don't need a referralfrom a Primary Care Doctor in order to see a specialist. And there is no In Network Out of Network Nonsense, and2) The Medex Supplement comes in two flavors:

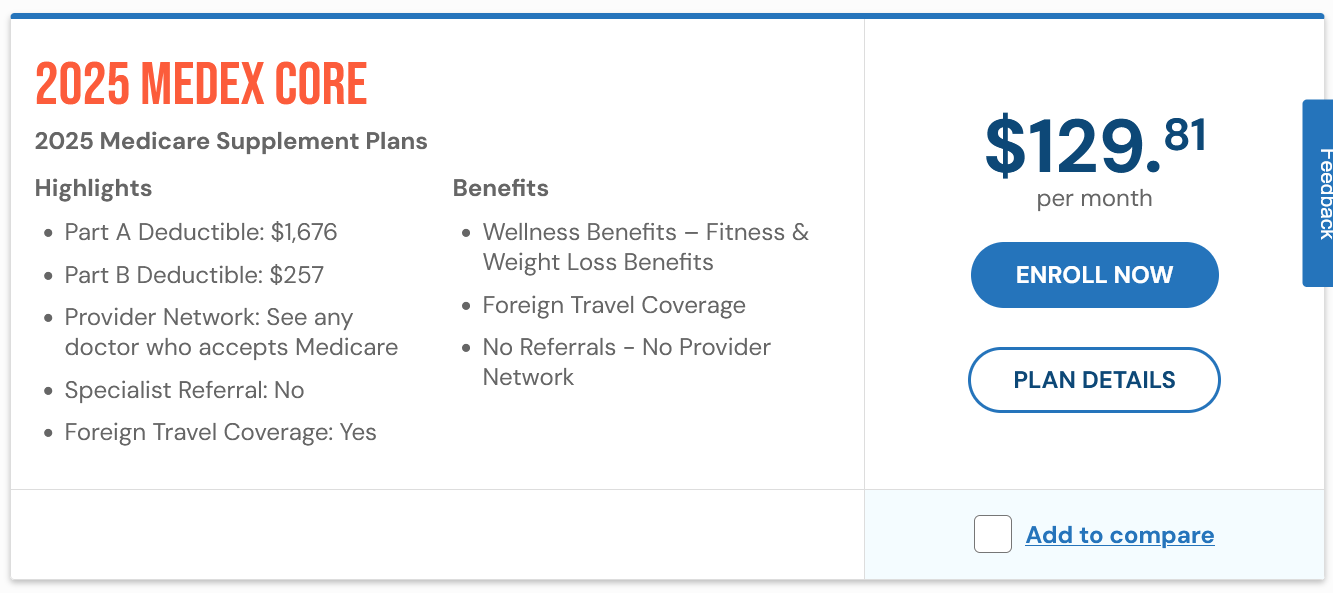

Medex Saphire $212 premium $257 deductible, andMedex Core $130 with a ~$1600 part a deductible and a $257 part B deductible.

So you can save $984 in premiums, but if you need medical care you could end up paying it in deductibles.

I was on the Saphire plan at 65, had two total hip replacement and they paid all of it.

I went on the second lower plan the following year paid $1000 less in premiums and did not need much care so saved money, BUT here is the interesting part. The SHINE counselor told me that even though I was on the CORE plan, that if i found I needed an operation I could call Medex and go back on the Saphire plan which would kick in at the first of the month. So if it was an operation that could wait 3 weeks that would be the thing to do, change plans and schedule for following month. Of course it the operation were immediate I would not have time to do this.

Then after the operation when better, I can switch back to the Core plan.

So I can switch back and forth month to month. How messed up is that they let us do this?

Take quick look at the 2 screen captures attached explaining Saphire and Core-simply explained on the MA site.

The Advantage plans in Mass may be okay-I don't know but every time I look at them i remember something i read somewhere LOL "The more complicated you can make any financial transaction, the easier it is to fleece the consumer.

I looked the Blue Cross Blue shield medicare site in Georgia, put in your zip and lied about my age i.e. just signing up and thats when I saw plans A G and N - a little more complicated. But when I clicked the plans and used Compare the chart that came up was simpler.

From AI: No, Massachusetts does not have Medicare Supplement plans labeled G or N. Instead, Massachusetts has its own Medigap plans, including the Core Plan, Supplement 1 Plan, and Supplement 1A Plan.

All of this is enough to make you sick! LOL

As far as I know I can go off the medigap plan and could sign up for it again later but only during the open enrollment period, but I would not do that w/o verifying with Medicare and/or a Shine counselor. I probably should become a shine counselor and get the training-all the ones i talked to were old. Fyi 71 yrs

Explanation

- Massachusetts has unique Medigap plans because it's one of three states that can design their own plans.

- The state's plans cover state-mandated benefits and some other benefits.

- Massachusetts has some of the highest premiums for Medicare Supplement plans, but rates vary by person and zip code.

- Massachusetts Medigap plans use community rating, which means that the monthly premium is set for everyone and doesn't vary by gender or age

To find the best Medicare Supplement plan for your circumstances, you can: Get multiple quotes, Do your research, and Work with a licensed insurance agent.