You got scammed into buying a timeshare. Get ready to get scammed again.

In law school, we learned about the "rule against perpetuities" - the idea that you can't create a contract that goes forever and ever, amen. Even things like deed restrictions or covenants can be voided, as the living are not going to let the dead run our lives. For some reason, these things don't apply to timeshares - you sign up for one, you are signed up for life.

In some (rare) instances, you can sell a timeshare or convince the timeshare company to "take back" or even buy back the timeshare. Popular "name brand" resorts may allow you to do this - places like Disney have an endless supply of new suckers customers who might bite on the timeshare you're no longer using.

Other timeshares, not so much. If you signed up for a timeshare in a location that is, well, not really all that great, and the timeshare company hasn't kept up the place, they have no incentive to let you out of the contract. They can let the place run down and keep collecting "maintenance fees" forever and ever, and you're pretty much stuck, unless you want to declare bankruptcy and start all over again. But like with 20-year RV loans (which for a 68-year-old are essentially a lifetime) they are banking on the fact that you have enough assets and wealth that you won't pull the bankruptcy lever.

Problem is, you have no way of knowing, going into the deal, whether you can get out of it later on. An easy way to avoid this is to not get into the deal in the first place. Why commit yourself to a lifetime of payments when you can just rent the timeshare (or any timeshare, or a hotel room, or whatever) without having to make any commitment whatsoever?

Problem is, you have no way of knowing, going into the deal, whether you can get out of it later on. An easy way to avoid this is to not get into the deal in the first place. Why commit yourself to a lifetime of payments when you can just rent the timeshare (or any timeshare, or a hotel room, or whatever) without having to make any commitment whatsoever?

Like I've said time and time again, Welcome to the United States of Go Fuck Yourself - you are "free" on our libertarian society to commit financial suicide with the stroke of a pen. It begins at age 18 with those student loans, continues on by age 30 with a leased Acura, and then the over-wrought mini-mansion once you are "making good money" - and if you get that far and still haven't wised up, they sell you a timeshare.

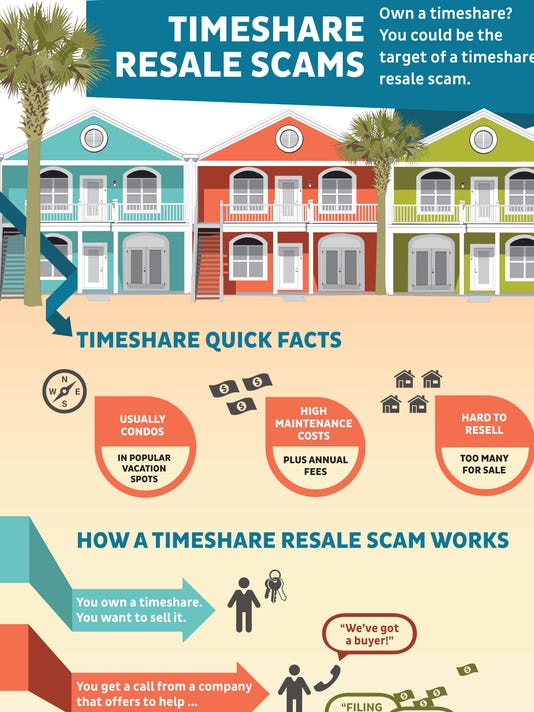

When you hit the ripe old age of 60 and realize you can't afford all this shit, they sell you a timeshare "exit"service - and just take more of your money and then evaporate.

One sure way to tell if a timeshare "relief" company is crooked is if they offer a "money-back guarantee!" which invention brokers also do. Sounds legit, right? A guarantee! But any guarantee is only as good as the company offering it, and if they refuse to pay you, then what? Of course, it goes without saying that just because they don't offer a money-back guarantee doesn't mean they are not crooked. Anything where they want money up-front, is probably a scam (think about it - your real estate agent never asked for his commission in advance, did he?).

The modus operandi of these "relief" companies is pretty simple. Start with saturation advertising. I saw one recently on the local Jacksonville paper website - it was not even labeled an advertisement, but a video "article" about "living". Curious, I clicked on the website. Not a lot there, other than pop-ups asking me to call them or to fill out a "leads" form. They also had a testimonial from a very sad old man who said nothing else but that "Trust" was a big issue for him, and he "knew right away" he could trust these people. No word on results.

They illustrated how the process works. Step one, you call them and give them all your contact information (and an up-front fee, not mentioned). Step two, get them the documentation of your condo. Step three, they look at this stuff. Step four - You're free! They've magically released you from our timeshare! How this works is not stated. Secret sauce, no doubt! They are looking for raging true-believers.

The real process is this - they ask for an up-front fee, usually in the thousands of dollars. One timeshare attorney site claims as much as $18,000 which sounds like a nice round number to ask for. It's a lot of money but not enough to sue anyone over. So if they take this money and do nothing, you have no recourse. It would cost you far more to sue them than $18,000. Invention brokers know this as well - it is how they work.

After enough people are browned off and their BBB reputation is shattered, they close shop and then reopen under a new name - oftentimes even decrying their old business as an example of "those crooked timeshare exit people!" but of course, their new company is the real deal!

Speaking of BBB, these folks are experts on putting up shill sites that laud them. You'll find "Timeshare Exit Review" sites that give them all five stars - or maybe they throw in one or two "disgruntled customers" who leave oddball reviews that can viewed as crazy. This way, it seems more real, but of course, all the reviews - even the negative ones - are fake, fake, fake. With regard to the BBB, they can "respond" to complaints and even settle with the complainant (for half the money or less, maybe) and thus the negative data is deemed "resolved" and their BBB score goes up.

But eventually they give up on even that, once they have several thousand people in the pipeline. If you get even a few thousand "customers" you've made several million dollars. And these operations are nationwide (although they claim to be based in your home town!). Their overhead is low - advertising is the biggest part, followed by the boiler room staff - many of whom never end up getting paid, anyway.

But eventually they give up on even that, once they have several thousand people in the pipeline. If you get even a few thousand "customers" you've made several million dollars. And these operations are nationwide (although they claim to be based in your home town!). Their overhead is low - advertising is the biggest part, followed by the boiler room staff - many of whom never end up getting paid, anyway.

But wait - there's hope - but not from where you might expect it. The timeshare industry itself is trying to shut down illegal "exit" companies. Of course, they might not have your best interests at heart! People have tried various legal strategies to get out from under timeshares - short of declaring bankruptcy. One way was to transfer ownership to a shell company, load up that shell company with a number of worthless timeshares, and then let it fail (not paying the maintenance fees on any of the shares in the interim). Timeshare companies responded to this by amending their contracts to state that any new owner must be approved by the timeshare company, and preventing people from transferring timeshares to shell corporations. That window might be closed, if your timeshare purchase was recent.

Another way is to find some wino bum and transfer timeshares to him. Again, the companies have changed their contracts to give them the right to approve new owners, which arguably might limit this option as well. If you start researching this whole issue, it almost becomes comical. One timeshare "exit" company criticizes others, saying they are corrupt, but that his operation is legit. It is hard to tell the good actors from the bad.

Or are any of them? Everyone, it seems, has a hand in this - a hand in your pocket. And as the fellow from one "exit" company notes, this wouldn't be an issue if the timeshare companies themselves were not bad actors - hounding people for maintenance fees and implying that their children and grandchildren will be obligated to pay these fees for generations to come.

As a result, some timeshare companies are offering exit options - if you have paid off the balance of the mortgage on the timeshare, that is. Once you have, they might let you go, since they have already emptied your wallet. It's like borrowing money from Tony Soprano. Sure, he might eventually let you go - after both your kneecaps are broken and he realizes he isn't going to squeeze much more out of you.

The real concern of the timeshare companies isn't you, or even their own reputation. It is the problem of the timeshare "termination" or "exit" companies running loud ads on the radio and saturation advertisements on the Internet. When all anyone hears about timeshares is what a hassle they are to get rid of, it kind of makes it hard for the timeshare companies to "hard sell" people at a weekend seminar.

Hard, but not impossible. The airwaves and Internet are full of adverts and articles telling people about the pitfalls of opiods and methamphetamine. All that being said, as you read this right now, some idiot in the United States - the wealthiest country in the world - is right now deciding to throw his life away by trying these drugs. Sometimes warnings can backfire in a big way. Sure, some people got hurt by timeshares - but those were dumb people and bad timeshares! I'm a smart person and this is a good timeshare! People say the same thing about drugs - that they can "handle" opiates or that it is possible (as one couple told me) to "have a responsible meth habit". They say the same things about student loans. My $100,000 degree in philosophy is going to line me up for a good job! It's those other people who screwed up - they must not have studied hard enough!

So, how do you avoid this trap? Simply by not stepping in it. It is no different than the motorhome trap or upside-down boat trap. Thinking of things in terms of monthly payment and not overall cost usually leads to trouble. Not thinking through to the "end game" also causes problems. A shiny new motorhome, boat, or timeshare resort sounds like a swell thing for today you. But what about Uncle Tomorrow and his needs? What happens down the road when you no longer want to use the boat, motorhome, or timeshare, but still owe more on it than it is worth? Uncle Tomorrow is screwed, big time!

Yet, this happens a lot to the middle-class - the target for these sort of raw deals. They are not really "scams" per se as what they are doing is perfectly legal. It's legal to screw people these days! Fun if you are the screwer and not the screw-ee, of course. I have avoided this problem largely in my life by following a simple rule: If it is a toy, and you want it, pay cash. Can't pay cash? Then you can't afford it.

Early on, I didn't follow this rule, and bought hobby cars and a swimming pool using loans. While I didn't end up bankrupt over this - a rising real estate market and the opportunity to "cash out" saved me - I ended up squandering an awful lot of money this way. I could have had a smaller pool, paid-for in cash, if I had merely saved up for a year. I could have had - and did have - a cheaper hobby car that actually was more fun to play with. Sometimes, less is more - in fact, most times. The "dream" car, boat, RV, or vacation, often ends up being a nightmare, or at the very least, less enjoyable than one thinks.

A far more flexible and cheaper way to vacation is to just pay for your vacation when the time comes. This might actually mean renting that same timeshare using AirBnB or whatever, or staying in a hotel or other resort, or going on a cruise, taking a train trip, traveling by RV, a packaged bus tour - or whatever you want to do. And if you lost your job, you can stay home and fold laundry and work on your resume - you have choices, instead of being locked into the same thing for the rest of your life.

Boats and RVs have 20-year loans, tops (although I am sure the the Boat and RV people look on in envy at the timeshare people and their perpetual contracts! Odds, are, they are developing something like that for Boats and RVs as we speak. Oh shit. They already have!). But generally speaking, there is an "end game" with a boat or RV loan - you pay it off, donate the shattered remains of the boat or RV to charity, and walk away. But with timeshares, no such luck. Do people really not think this through? What happens when you are 80 and using a walker and in the retirement home? You still have to pay that timeshare fee, every Goddamn year!

People complain about a "shrinking middle class" in America, but from what I can see, the middle class has shrunk not through the machinations of others, but because the middle-class willingly hands over their cash to other people. Middle-class people are smart enough to get a good-paying job (or join a union and get a good-paying job even if they aren't smart). In either case, they aren't smart enough to know how to handle money, which was why, in the past, we had laws regulating a lot of financial transactions, and we paid retirees in pensions, not lump sums, as we knew full-well what middle-class people will do with any check with more than four figures in it. Take-out meal and a trip to the car dealer! Ya-hoo!

I wish this wasn't the case. I wish these raw deals didn't exist. I wish people were smarter than that. But then again, on the other hand, there is someone out there, right now, who is not a shill for a timeshare company who will tell me what an "idiot" I am for not "getting" what a great deal timeshares are! It is no different than the guy who laughs at me for having a "tiny" paid-for camper, instead of a $500,000 bus motorhome that he is making payments on. Did you see his outdoor kitchen and big-screen tee-vee? He's winning! I'm not playing.

And I guess that is the secret to this game - to just not play. I have friends who went to a timeshare seminar to "get the free barbecue grill" and of course, they wouldn't fall for that sort of high-pressure sales pitch, right? Well, they came back from the seminar and were kind of quiet about what happened. And a few months later, they told us they bought a "condo" at a ski resort. But when I looked it up online, the "condo" was - you guessed it - a timeshare. That was one expensive barbecue grill!

You can't "steal the cheese" at a timeshare seminar. They prey upon your weakness, just as the credit card people do. You can't "play the float" with credit card companies - you will end up carrying a balance and end up paying enormous amounts of money in interest - which you then pay off with a home equity loan. This is how the middle class has squandered away their wealth.

The scary thing is, many people make these bonehead decisions thinking they are smart moves. That home equity re-fi was a smart deal, right? After all, you can deduct the interest! I am sure the same argument is made at timeshare seminars - vacation home interest is, after all, deductible! And leasing a car? Frees up your cash-flow and don't forget opportunity cost - all that money you have laying around could be better spent investing for the future!

But there is no money laying about. The middle class hasn't a nickel to their name. It's all borrowed money, and they are borrowing yet more, using these mantras to convince themselves that living paycheck-to-paycheck is smart living. You try to suggest to them that maybe there is another way, and not only do they say you're crazy, they lash out at you.

So, over time, you lose sympathy for such folks. You couldn't help them if you tried. And people have tried. Elizabeth Warren's consumer protection agency is one of a long-line of regulations designed to rein in these sort of raw deals. The people who sell this stuff simply reorganize and figure new ways around it. In some instances, disclosure laws, such as those which require lease deals to display price and interest rate prominently, or invention brokers to display success rates prominently, and so on and so forth simply don't work. The companies comply with these laws, but of course bury this "prominent" data with more irrelevant data, as well as verbal promises made over the phone or in person. Net result - these folks are all still in business, and more and more people are ripped off. You can't fix stupid.

The only real recourse is for the individual to look out for themselves. Don't assume that something that is advertised on television is "legit" because the television station somehow vetted the advertisement.

We have an awful lot of freedom in this country - something we are proud of and defend. But freedom also means responsibility, because if people are to be free, they have to be free to make good choices and bad choices. If the State makes choices for us, then we aren't really free - and besides, the track record of governments making choices for us, kind of sucks.

I wish there was a better answer. But that's the way the world works - always was, is, and will be. You have to look out for each other, if you can. But most importantly, you have look out for yourself. The people who get caught up in these scams forget this - they assume others are looking out for them - that the timeshare salesman has their best interests at heart. It is just foolish thinking!

We have an awful lot of freedom in this country - something we are proud of and defend. But freedom also means responsibility, because if people are to be free, they have to be free to make good choices and bad choices. If the State makes choices for us, then we aren't really free - and besides, the track record of governments making choices for us, kind of sucks.

I wish there was a better answer. But that's the way the world works - always was, is, and will be. You have to look out for each other, if you can. But most importantly, you have look out for yourself. The people who get caught up in these scams forget this - they assume others are looking out for them - that the timeshare salesman has their best interests at heart. It is just foolish thinking!