There is no shortage of websites and blogsites claiming to have a " system" for trading stocks. Sorry, folks, but there is no Santa Claus.

Stock trading systems just don't work, just like horse racing systems don't work. Yes, there are people who "play the ponies" using systems based on numerology, or the names of the horses, or other non-horse indicia. And while statistically, some of these folks will be successful once in a while, for the long-term, such systems simply don't work.

You are better off instead, looking at the horse itself - its racing history, its "track record" and its performance under different conditions. Horse-based indicia (and jockey-based indicia) are a far better barometer of performance than some numerology-based system.

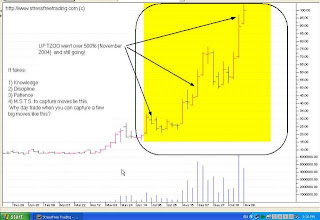

And yet, the stock-system people will tell you that you can trade stocks without understanding the underlying company at all. Rather, all you need to do is look at the stock price chart over time. And of course, they can, in retrospect, show you how their system works - or would have worked - using historical information. But fantasy trading of stocks based on historical data is like rotisserie baseball - it simply isn't real.

In order to make money trading stocks, you need to understand the fundamentals of the company finances, its products, its profitability, its price-to-earnings ratio, and other horse-based indicia. You can't look at the stock price chart and see or spot a pricing trend, as these trends are often based on the company's underlying performance. So, if a stock is going UP that usually has more to do with the company's financial status, than some "pricing trend" - and if the price goes DOWN that is usually related to a company's financials or bad news, or the like.

Now, of course, there are exceptions to this rule. As I noted in an earlier posting, stock prices, like anything else, are affected by the law of supply and demand. So if a lot of people are buying, the price goes up, and if a lot of people are selling, the price goes down. And oftentimes these price shifts are unrelated to fundamental value. If you could determine the supply and demand, you might be able to make some strategic trades based on that factor alone.

For example, companies routinely invest shareholder's dividends into new stock, using the shareholder dividend reinvestment service. As I noted in another posting, this is a win-win for the company and the shareholder, as the company can use this service to keep the stock price up, while the shareholder can buy more shares for only a nominal service charge (e.g., $1 or so).

But I have noticed over the years that the company's share price tends to go up very slightly on the day the shareholder's dividends are reinvested. Perhaps this is because the company is placing a fairly large "buy" order on that day. Usually, the day after, the price drops down a bit. Not a lot, but slightly. So, there is an instance where there is a "system" where prices fluctuate slightly based on non-performance indicia.

So you might be able to create a trading scheme based on this principle. However there are two problems with trading schemes. First, if they really worked consistently, everyone would use them - after all, who doesn't like free money? So very quickly, the schemes would fall apart. If you ever come across a foolproof scheme for trading stocks, you would never, ever tell a single soul about it, as it would unwind the scheme in short order. For that reason alone, you should look upon all "stock trading systems" being sold out there as utter frauds.

But the second reason such a scheme wouldn't work - consistently - is that other market movements would far outweigh the "noise" in the market price. So, for example, you figure out that the price of ACME stock goes up 50 cents (about 1% of market value) every quarter then the shareholder dividends are reinvested. But it drops right down again the next day. So the next quarter, you buy 10,000 shares of ACME the day before dividend reinvestment day, hoping to sell it all the next day and make a quick $500 on your $50,000 investment (that you may have made using futures trading).

But the next day, it is announced that ACME is facing a multi-billion dollar lawsuit for toxic waste cleanup. The share price of the company drops $5 (10% of market value). Suddenly, you are properly fucked, big time, particularly if you are option trading. Real signal can outweigh background noise in a real hurry. And if you are trading on background noise and not real signal, you can get wiped out by failing to notice the signal-to-noise ratio.

For the small investor, there is no "system" and trying to game stock prices is a sure way to lose a lot of money in a real hurry. Look to invest for the long haul. It may not be sexy or fun, but it returns money, in the form of equity increases and dividends.

And if someone tries to sell you a stock trading system, ask yourself why anyone would sell such a system, if it really worked. Why sell the goose that laid the golden egg, when you are getting all those golden eggs?