It is all-too-easy to influence opinion on the Internet, which does not bode well for the economy.

Trolls. You probably have read postings and comments from them. Some you can easily spot, others are less so. For example, go on a Youtube channel with videos about Russian military hardware. You will see poorly-worded comments lauding the great technological advances of Russia, and downplaying the US. There will also be ominous comments how the sinking of the Russian sub Kursk was caused by ramming by an American sub, and not just poor design and incompetance on the part of Russia (I've owned a Russian motorcycle, please don't attempt to tutor me on Russian "technology" thank you).

But other trolls are harder to spot, but you can spot them if you know what to look for. And not all of them are on the Internet - some appear on television as well. For example, the guy who got on the financial channels and started blathering about how gold was going to hit $5000 an ounce "any day now" was basically trolling - and his company was (surprise, surprise) selling gold.

But at least in the "real world" you might get exposed to opposing views on subjects. On the internet, you can insulate yourself in an Igloo cooler and not hear any contrary voices, other than muffled sounds from outside. And in those sort of forums, it isn't hard to spot the trolls - almost everyone is!

Reddit is an example of such a site. They have all these "subreddits" on different topics, and usually there are "rules" for posting on each subreddit. In most subreddits, the "rules" can be boiled down to, "don't post anything that challenges the group-think!" And it doesn't matter whether it is a right-wing subreddit like r/the_donald or a left-wing one like r/latestagecapitalism, if you post something that people don't want to hear, the moderator will erase it.

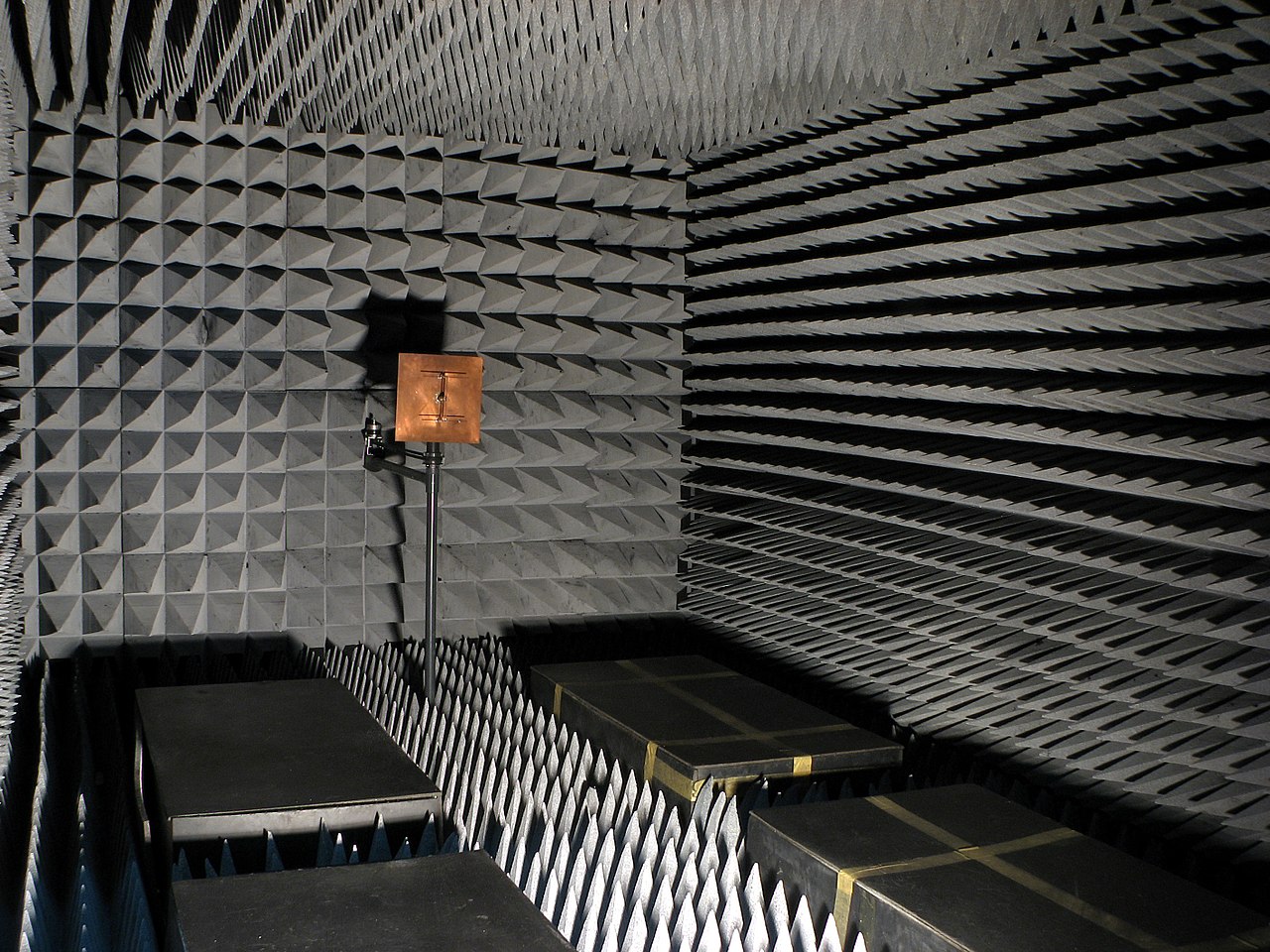

The perfect anechoic chamber. We had one of these in the labs at Carrier, for noise-testing air conditioning components. It was lined with tapered cones made of foam, and when you closed the vault-like door, there was a silence like you never heard in your life. The room was "dead" and when you talked, it sounded like your voice trailed off mere inches from your mouth. That pretty much describes the Internet these days. You can barely hear your own voice, much less that of others.

So people are going on Bitcoin discussion groups, where terms like "blockchain" and "fiat currency" are bandied about, without anyone really knowing what they mean. Fiat currency is money not backed by anything, which in a nutshell describes Bitcoin - but no one wants to talk about that. The big argument for its value is supply and demand based on emotional investing. We are told there are a "limited" number of Bitcoins, but already Bitcoin has shed off a subsidiary currency, Bitcash, which sort of blows that argument out of the water. Moreover, even if we assume there are a limited number of Bitcoins, there appear to be an infinite number of cryptocurrencies, which means that another currency could come along and replace Bitcoin, particularly one that takes less than five hours to process a single transaction.

And the reality of Bitcoin is a lot of bad news. The stated purpose of it - as an alternative currency without expensive transaction fees - is really a lot of hooey. It is cheaper to use a credit card, even with 2-5% processing fees, than to accept Bitcoin. The reality is, however, only a few online retailers accept Bitcoin - three to be exact. And while this "currency" is supposed to be a medium of exchange, no one is using it for that, but rather they are merely hoarding it as an "investment".

Well, people doing illegal things might be using it as a medium of transaction. If you got smacked by the Wannncry ransomware, you might have had to send Bitcoin to North Korea to get your hard drive back (shame on you for not backing up!). So that's the fun part about Bitcoin - its links to illegal activity, which governments worldwide will tolerate indefinitely.

The funny thing is, if you Google the word, "Bitcoin" you are treated to page after page of articles about how great Bitcoin is, and no pages about how Bitcoin is a big, huge, bubble. In fact, it arguably is the first Social Media Bubble, driven entirely by conversations in the echo chamber of social media. The people "investing" in Bitcoin are hearing only one side of the story, as any contrary arguments are shouted down. So you see articles like this one, where kids dropped out of college because they made a whopping $15,000 in Bitcoin (now they're set for life!).

And the reality of Bitcoin is a lot of bad news. The stated purpose of it - as an alternative currency without expensive transaction fees - is really a lot of hooey. It is cheaper to use a credit card, even with 2-5% processing fees, than to accept Bitcoin. The reality is, however, only a few online retailers accept Bitcoin - three to be exact. And while this "currency" is supposed to be a medium of exchange, no one is using it for that, but rather they are merely hoarding it as an "investment".

Well, people doing illegal things might be using it as a medium of transaction. If you got smacked by the Wannncry ransomware, you might have had to send Bitcoin to North Korea to get your hard drive back (shame on you for not backing up!). So that's the fun part about Bitcoin - its links to illegal activity, which governments worldwide will tolerate indefinitely.

The funny thing is, if you Google the word, "Bitcoin" you are treated to page after page of articles about how great Bitcoin is, and no pages about how Bitcoin is a big, huge, bubble. In fact, it arguably is the first Social Media Bubble, driven entirely by conversations in the echo chamber of social media. The people "investing" in Bitcoin are hearing only one side of the story, as any contrary arguments are shouted down. So you see articles like this one, where kids dropped out of college because they made a whopping $15,000 in Bitcoin (now they're set for life!).

But I am just using Bitcoin as an example. The goldbugs have their own forums with their own trolls. And the trolls are there for a purpose - to promote the sale of gold, because they work for companies selling gold, just as the Bitcoin trolls work for companies selling Bitcoin. And there is a lot of money to be made in Bitcoin - not by buying the coins, but in the transaction fees. Levi Strauss effect kicks in - more money to be made selling blue jeans to gold miners than there is in mining gold!

The staggering transaction fees sort of negate one of the stated advantages of Bitcoin. As I noted in a posting a long while ago, the fees I had to pay in foreign transactions were annoying. Wire transfers cost $20 or more to send - and to receive! (UPDATE: Many banks offer free wire transfers for preferred customers). This made sending small amounts of money a pain-in-the-ass. Credit card companies want 2-5% of the proceeds, plus monthly fees to have a "merchant account". PayPal is one workaround on this, and newer transfer methods for personal use are coming online - using cell phones for peer-to-peer money-sharing.

But when it costs more to use Bitcoin and takes longer than using a credit card or even a wire transfer - then what's the point? Oh, right, money laundering, drugs, terrorism, sex-trafficking. The governments of the world will let that go on indefinitely, right? Wrong.

But the Bitcoin faithful see none of this. In their minds, Bitcoin is going to replace traditional currencies eventually and we all will do transactions using Bitcoin - even though the checkout line at Wal-Mart will take days to go through and the transaction costs will bankrupt everyone. That could happen, sure. Pigs could fly, too.

The problem with that argument, of course, is that not only is it not working, but that Visa and Mastercard are not going to go quietly into the night. If Bitcoin or some other "cryptocurrency" really was cheaper and easier to use (and more secure - another problem for Bitcoin, due to all the thefts and corruption) then the folks at the traditional credit card companies would certainly take action if they saw market share shrinking. They would slash fees and make things easier to use. And to some extent they do - offering cash-back bonuses to the best customers (much as the railroads offered "rebates" to John D. Rockefeller) to lure business. They will not merely sit on their hands and do nothing and watch their industry die.

And so on down the road. It doesn't matter if it is houses, stocks, gold, or whatever - when all you hear is the sound of your own voice and not that of others, bad things will happen to you. When we were in South Florida in the 2000's, it as like that as well - everyone was repeating what everyone else was saying - "Buy now before you are priced out of the market!", "Real estate will always go up in value!" and so forth. Maybe it was more of an echo chamber than an anechoic one. But the result is the same. Listening to only one side of a story is always bound to cause trouble.

This video explains how Bitcoin works and why you should invest!