Most houses are sold on monthly payment. Interest rates determine how much house you can buy for a given monthly payment.

A reader writes asking whether small changes in interest rates will really affect housing prices. Boy-howdy they do! Houses are sold on monthly payment - most houses that is. Sure, the million-dollar penthouses in New York (more like $30 Million) are sold to cash buyers and they don't give a shit about interest rates. Borrowing money is for plebes.

The rest of us are plebes. Get over that.

So you and I, as young people, set out to buy a house and we figure that since we are making $100,000 a year (let's say) that we can afford to pay about 1/3 of that in monthly mortgage payments. Let's take aside taxes and insurance for the moment and concentrate on "P&I" - or Principal and Interest. So let's say we have $36,000 a year to spend, or about $3000 a month.

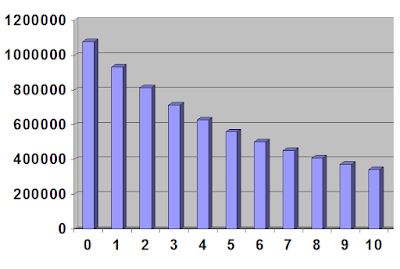

If mortgage interest rates were zero, well, that $3,000 a month would pay for a $1,080,000 house amortized over 30 years. Sweet! But of course, mortgage rates are never zero for us plebes. For each increase in interest, you can calculate how much that $3000 a month will buy. The results are rather startling and non-linear. From 0 to 1%, the amount financed drops from over a million to about $900,0000. From 1% to 2% to $800,000 - and so on down the line - dropping by about 10% in purchase power for each 1% increase in mortgage rates. The biggest drops occur at the lowest interest numbers. When you go from 2% to 3% you lose nearly a hundred grand. When you go from 5% to 6% it is only 50 grand, but by then our purchase power has dropped from nearly a million to a half-million.

The chart above, which I crudely made in WORD 2000, uses data from a BANKRATE mortgage amortization program. As you can see, for each 1% increase in mortgage interest rate, the amount of house you can buy for $3000 P&I drops off by about 10%.

What this means, in real terms, is that if interest rates go up 1%, well, buyers paying the same monthly payment can only afford to pay 10% less for your house - unless of course, wages go up as well, which they sadly are not (at least in most areas). Some buyers may still buy, by increasing the percentage of income they use for mortgage payments. But eventually they enter a region of mortgage stress, and eventually a region of un-affordability.

Let's say our mythical house in Fairfax County was sold to Suzie and Bill for $700,000 which is considered inexpensive in that hot market. They financed the house at 3% interest for a monthly P&I of about $3000. Now, a year later, Bill gets transferred to LA and wants to sell the house. Ted and Shandra want to buy it and can afford to pay $3000 a month also. But mortgage rates have gone up to 4% so the most they can afford to pay is $630,000 or about 10% less than Suzie and Bill paid for the house.

If the house is listed for $700,000 then Ted and Shandra might not even look at it as it is out of their price range. So the number of potential buyers is reduced. When demand drops, so do prices. Now, note that this doesn't happen in real-time. Prices don't track exactly. Ted and Shandra might "bite the bullet" and increase their monthly payment to about $3350 a month - a 10% increase in payment for a 1% increase in mortgage rate! Note how this 1%/10% ratio seems to work either with monthly payments or purchase price. A 1% increase in mortgage rates means a 10% increase in payment or a 10% decrease in loan value.

The problem for Suzie and Bill is that if Ted and Shandra don't pony up the dough, then they will have to lower their asking price. And we have to hope they don't have to lower it to less than the loan amount. With a 1% increase in mortgage rates, maybe they lose their down payment. With 2% or more, well, they might be "underwater" on their mortgage.

Note that this also works with variable-rate notes only it's worse. If Suzie and Bill signed a variable-rate note and the rate goes up a point or two, their monthly mortgage payment could go up 10-20% respectively. This puts a lot of financial stress on Suzie and Bill. And since they already own the house and signed the mortgage, they are stuck. And no, they can't "just refinance at a lower rate" as rates have gone up. I've heard that nonsense from real estate agents in the past, trying to sell me a variable-rate note. It made no sense then, it makes no sense now.

There are ancillary effects as well. Since interest rates have been so low for the last few years, housing prices have jumped up. Again, lower rates mean people can afford to pay more for a house for the same monthly payment. And in hot markets like Fairfax County or San Francisco, you are competing against other buyers who will pay as much as they can afford in monthly payments to beat your offer. As a result, many of these homeowners start out in mortgage stress - pushing their finances to the limit to buy a home.

Higher prices means higher tax assessments. And in some markets, such as the Northeast or Florida, property tax bills can be in the five digits. In New Jersey, $1000-a-month tax bills are not uncommon. So add another grand to Ted and Shandra's monthly mortgage payment and they just have to hope they get a raise at work - and God forbid they lose their jobs!

As I noted in an earlier posting, things like insurance can factor in. We saw this firsthand in Florida back in the early 2000's where back-to-back hurricanes jacked up insurance costs into the thousands, just for an ordinary house. You need flood, wind, and fire policies there - and each can run a grand or two, just for a simple two-bedroom bungalow near the beach.

So, taking all this into consideration, what will happen to the housing market now that mortgage rates have already jumped a full percentage point before the Fed has even raised rates? It means monthly payments will go up, or housing prices will go down. And since wages for many people are flat, well, monthly payments can only go up so much. Did you get a 10% raise this year?

The thing is, I've seen this pattern happen again and again in my lifetime. Actually, I've seen a number of financial patterns again and again. People go out and buy cars like mad, all at once - and pay the highest possible prices. Two years later, sales slack off and the dealers are offering discounts. Right now, housing is berserk and yet everyone wants to buy - before they are priced out of the market forever! (I've heard that canard time and time again). Or they want to remodel - when there is a shortage of materials and labor! It is like the folks driving from Washington DC out on Route 50 to the Eastern Shore of Maryland or Rehoboth Beach, Delaware, every weekend in the summer - everyone doing the same damn thing at the same time and having the worst experience - traffic, crowds, high prices, and poor service. Meanwhile, if you drive out on a Wednesday, you zip right along with no backups, and the hotels and restaurants are not crowded - and offering discounts.

Act rationally in an irrational world. Don't be a lemming.

Sadly, I am reading right now online about people who are "buying now before rates go up further!" and bidding housing prices into the stratosphere. Two years ago, a house sold down the street from us for under $300,000. Yesterday, a deal closed on a house asking $730,000. It is crazy. During the last Real Estate Bubbles (2008 and 1989) the people who got hurt the most were the ones who bought right before the bubble burst. And often these were folks who waited and waited as prices went up. They thought, rightfully, that a bubble was occurring. But then then panicked and decided they better get in while they still could! And a helpful real estate agent showed them a fancy new loan instrument that could "get them into the house" at a monthly rate that was at least initially attractive.

The sad thing is, a whole generation has been raised on super-low interest rates. Traditionally, "bank interest" meant that mortgage rates were about 6% while savings rates were around 3% and you borrowed money from the local bank, not from some Wall Street firm. It all went crazy in the 1980's with 14% rates (!!!) that caused housing prices to stagnate. When rates dropped to "only" 9% or so, we had our first housing boom which crashed in 1989. Mark and I bought our first house together on a "3-2 buydown" loan that started at 8-5/8% and then went to 11-5/8% two years later. We were fortunate in that rates did go down and we could refinance to "only" 7% or so. You toss those numbers at "kids today" and they simply don't believe you.

Speaking of which, I will punch in the face the next young person who tells me how "lucky" we were back in the day. You could buy a brand-new Camaro in 1969 for only $4000! But of course, it was a deathtrap of a car with drum brakes all around and an AM radio and lap belts only. Airbags? You're kidding, right? And $4000 back then is worth over $30,000 today. Prices go up over time, and comparing prices today with yesteryear is stupid - but we all did it or do it.

I remember old-timers grousing about how a Pepsi was only a nickel back in the day. 25 cents for a can of soda? An outrage! Today it is over a buck in the vending machines - not that I drink that crap anymore (I'm saving my carbs for adult beverages, thank you!). It is a stupid game, really, comparing prices from yesteryear to today.

But interest rates? That's a different story - they track over time. 10% today is the same as 10% back then, and 10% mortgage rates suck, let me tell you. But then again, most people slept through math class because "fractions are hard" so they believe stupid things like a Real Estate agent deserves a 7% commission (instead of 6%) because prices have gone up, or that a waitress deserves a 20% tip instead of a 15% tip because of inflation. Percentages track inflation. Inflating percentages is inflating inflation. But I digress.

During the last two bubbles there were a plethora of bubble deniers. "Let's hope for a soft landing" was the mantra of 2006. And if interest rates are raised gradually and only by a percentage or two, this may be the result. But I am skeptical. The problem is, we've kept rates so low for so long, and inflation is already starting to run away. The Fed is like a poorly-made cruise control with too much hysteresis. It over-shoots and under-shoots, and politicians try to tinker with it to make short-term gains in the economy to get re-elected.

Trump goosed the economy in the first part of his term, and then they really goosed it to counteract the pandemic. Now we have to pay for all that "free money" that was thrown around during the Trump administration. But people being stupid (again, sleeping through math class) will blame whoever is in office when the fuse finally burns down on that stick of dynamite.

Quite frankly, I wish I was in a position to profit from this bubble - to cash-out of my real estate while the getting is good. But our condo is tied up in redevelopment, and unless we want to take a couple of years off and live in the camper, I am not sure where we would live, if we sold our primary residence. The good news is, since it is paid-for, we don't have to worry about being upside-down or being foreclosed upon. And we have no jobs to lose - but a 401(k) that will no doubt be decimated.

Of course, there are other things that may affect an economy. Wall Street is freaking out at the prospect of World War III. Or imagine Europe cuts itself off from Russian natural gas in the middle of winter. Or suppose China nationalizes all the US factories we've built there - or that GM can't sell Buicks there as it would be seen as "unpatriotic" to the Chinese? Suppose we had to start making things in the USA instead of importing them? Anything is possible - that is the problem with predicting the future.

But I can say with certainty that if you raise mortgage interest rates, housing prices will go down, or at best flatten out. It is a law of nature - unless people all get corresponding raises, but I doubt that is about to happen. And if it does..... high inflation is an ugly thing.

Cheerful stuff, I know. But being rational is value-neutral. Wishful thinking might seem like more fun, but it leads to tears every time!