Pay off all your debts and live debt-free and they punish you!

At a reader's suggestion, I used annualcreditreport.com to space out my three credit reports over the year. I have "locked" my credit on all three reporting agencies, so there is little risk of being hacked or whatever. But it is an interesting exercise to look at credit reports and of course, it is good blog meat.

I tried to log onto annualcreditreport.com to check my Experion report, but Experion gives this odd message that "something" prevents them from showing my report. At the same time, I get an e-mail from Experion telling me my report and score is ready - just log in! I set up an account with them during a security breach years ago, and still have it. Yes, it is handy as you can lock and unlock your report with the click of a mouse. But like CreditKarma(whore) they try to sell you credit cards and car loans and whatnot. Turns out the credit score is a good selling gambit.

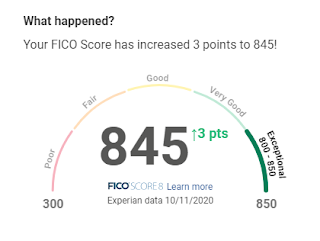

Anyway, our scores went down a bit - at one time we had "perfect" credit scores, but since we paid off all our debts, our scores actually dropped. Here is Mark's score report - a "777" score - note the explanation at the bottom as to why our score isn't higher:

FICO® Score 8

Your score is above the average of U.S. consumers and demonstrates to lenders that you are a very dependable borrower.

What's helping

No missed payments

- You have no missed payments on your credit accounts.

- Number of your accounts with a missed payment or derogatory indicator: 0 accounts

- About 98% of FICO High Achievers have no missed payments at all. But of those who do, the missed payment happened nearly 4 years ago, on average.

- The FICO® Score evaluates if there are any missed payments being reported. Staying current and paying bills on time demonstrate lower credit risk.

Recent credit card usage

- You've shown recent use of credit cards and/or bank-issued open-ended accounts.

- FICO® Scores evaluate the mix of credit cards, installment loans and mortgages. People who demonstrate recent and responsible use of credit cards and/or bank-issued open-ended accounts are generally considered less risky to lenders.

Not seeking credit

- You're not actively looking for credit.

- Your applications for credit in the past year: 0 inquiries

- About 70% of FICO High Achievers did not apply for credit in the past year.

- Each time a person applies for credit, a credit inquiry is usually added to your credit report. Your credit report shows relatively few or no recent credit inquiries, which indicates that you are not actively looking for credit. People who are actively seeking credit pose more of a risk to lenders than those who are not.

No collection or public record

- You have no public records or collections on your credit report.

- Number of public records on your credit report: 0 public records

- Virtually no FICO High Achievers have a public record or collection listed on their credit report.

- Number of collections on your credit report: 0 collections

- Virtually no FICO High Achievers have a public record or collection listed on their credit report.

- Lenders would consider the fact that you have no public records or collections on your credit report as positive. The presence of a public record (such as a bankruptcy) or collection is a powerful predictor of future payment risk - people with these items on their credit report are much more likely to miss future payments than those without them.

What's hurting

No loan activity

- You have a lack of recent activity from a non-mortgage installment loan.

- Your credit report shows a $0 balance on your non-mortgage loans (such as auto or student loans) or a lack of sufficient recent information about your loans. Having a non-mortgage installment loan with no missed payments and a low balance along with other types of credit demonstrates that a person is able to manage a variety of credit types. Having a 0% installment loan balance to loan amount ratio is considered slightly more risky than having a low installment loan ratio.